cryptoforu.site Market

Market

Lite Loans

:max_bytes(150000):strip_icc()/Covenant-lite-3c5405379fce4bcaa1e66eecfb4b94b1.jpeg)

Cov-lite loans are now the norm in the large-cap loan segment, while cov-loose loans and add-backs to EBITDA are gaining ground in mid-market deals. We get Minnesotans out of predatory loan debt (payday, pawn, auto title, and online installment loans, etc.) and back on track financially. A covenant-lite (or cov-lite) loan is a borrower-friendly type of loan facility found in certain leveraged financings. Cov-lite loans are most. Bright Lending offers quick, online cash options when your life and your expenses aren't always on the same schedule. Bad credit or no credit. We offer financing for new or pre-owned 1 cars, light trucks, and motorcycles. And you can get an interest rate reduction of % by setting up an automatic. LendingTree helps you get the best deal possible on your loans. By providing multiple offers from several lenders, we show your options, you score the win. LightStream offers fast, easy financing for almost anything to good-credit customers. Get low, fixed rates and great service. Apply now for a lightstream loan. Cov-lite (or "covenant light") is financial jargon for loan agreements that do not contain the usual protective covenants for the benefit of the lending. Covenant-lite loans are not covenant free. In our experience, covenant-lite loans have more covenants than high yield bonds. They lack at least one. Cov-lite loans are now the norm in the large-cap loan segment, while cov-loose loans and add-backs to EBITDA are gaining ground in mid-market deals. We get Minnesotans out of predatory loan debt (payday, pawn, auto title, and online installment loans, etc.) and back on track financially. A covenant-lite (or cov-lite) loan is a borrower-friendly type of loan facility found in certain leveraged financings. Cov-lite loans are most. Bright Lending offers quick, online cash options when your life and your expenses aren't always on the same schedule. Bad credit or no credit. We offer financing for new or pre-owned 1 cars, light trucks, and motorcycles. And you can get an interest rate reduction of % by setting up an automatic. LendingTree helps you get the best deal possible on your loans. By providing multiple offers from several lenders, we show your options, you score the win. LightStream offers fast, easy financing for almost anything to good-credit customers. Get low, fixed rates and great service. Apply now for a lightstream loan. Cov-lite (or "covenant light") is financial jargon for loan agreements that do not contain the usual protective covenants for the benefit of the lending. Covenant-lite loans are not covenant free. In our experience, covenant-lite loans have more covenants than high yield bonds. They lack at least one.

We make loans to people, not credit histories. We make decisions based on individuals, not just scores. Determining your needs, budget and qualifications. Marketplace lending typically involves a prospective borrower submitting a loan application online where it is assessed, graded, and assigned an interest rate. Policy-based Lending Policy-based loans or PBLs provide the Bank's borrowing member countries with flexible, liquid (fungible) funding to support policy. On the Road Lending's loan fund, OTR Fund I, LLC, is a Community Development Financial Institution (CDFI) certified by the U.S. Department of the Treasury. Finance what you want with a LightStream consumer loan — our virtually paperless online loan process is refreshingly fast and simple. Explore MeridianLink's industry-leading suite of digital lending solutions for banks, credit unions, fintechs, and more. The Federal Reserve established the Main Street Lending Program (Program) to support lending to small and medium-sized for profit businesses and nonprofit. Collateral is usually not required and personal loans typically have lower interest rates than most credit cards. Since interest rates and loan terms on a. Amazon Lending is designed to help your business succeed by letting you free up cash flow and invest in the areas of your business that make sense. Join. We are a National Voice Against Abusive Financial Practices. The Center for Responsible Lending is a non-partisan, nonprofit research and policy advocacy. A covenant-lite (or cov-lite) loan is a borrower-friendly type of loan facility found in certain leveraged financings. In the past, cov-lite loans were most. With the ability to choose a loan amount of up to $40,, LendingClub offers fixed rates and a monthly repayment plan to fit within your budget. We understand. SBA lending depiction: SBA partners with lenders to reduce risk and enable easier access to Like seasonal financing, export loans, revolving credit. Merrill and Bank of America offers borrowing options, such as mortgages, lines of credit, custom lending, and auto loans for your personal and business. We want to make sure you get the right home loan for your financial goals. Whether it's purchase or refinance, cash-out or remodel, we offer great loan. Ally Lending is now Synchrony. Log in at Synchrony to access your personal loan account. Discover more about managing your other Ally accounts. Home Buying Made Easy. National lender. Local loan originators. Our focus on technology bridges the gap between online and in-touch. Complete all loan. The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices. It requires lenders to provide you with. How a Personal Loan with LendingClub Works · Apply In Minutes. Get customized loan options based on what you tell us. · Choose a Loan Offer. Select the rate. Open Lending provides automated lending services to auto lenders. Open Lending specializes in loan analytics, risk-based pricing, and risk modeling.

Term Deposit Calculator

FD Calculator - Calculate fixed deposit interest rates and maturity amount online at HDFC bank. Use FD Calculator & calculate maximum interest earned on. Minimum investment $5, For deposits of 1 year or less, interest paid at maturity. Over 1 year, interest paid annually. See all term. Use this calculator to find out how much interest you can earn on a Certificate of Deposit (CD). Just enter a few pieces of information and we will calculate. Our savings and term deposit calculator has got your back. All you have to do is provide some basic information about your savings plan. Term Deposit Calculator NOTE: The calculation is prepare for an indication purpose only and it might be changed base on terms and conditions. - For more. You can calculate the amount you will receive at maturity and the interest you will earn using a fixed deposit calculator. The formula to determine FD maturity amount · P is the principal amount that you deposit · r is the rate of interest per annum · t is the tenure in years. Interest rates: A term deposit offers a fixed interest rate for the life of your investment. For example, “% p.a. for 3 months” or “% p.a. for 3 years”. FD Calculator lets you calculate your FD Return and Maturity amount based on the tenure. Plan your investment now with ICICI Bank FD Interest Calculator. FD Calculator - Calculate fixed deposit interest rates and maturity amount online at HDFC bank. Use FD Calculator & calculate maximum interest earned on. Minimum investment $5, For deposits of 1 year or less, interest paid at maturity. Over 1 year, interest paid annually. See all term. Use this calculator to find out how much interest you can earn on a Certificate of Deposit (CD). Just enter a few pieces of information and we will calculate. Our savings and term deposit calculator has got your back. All you have to do is provide some basic information about your savings plan. Term Deposit Calculator NOTE: The calculation is prepare for an indication purpose only and it might be changed base on terms and conditions. - For more. You can calculate the amount you will receive at maturity and the interest you will earn using a fixed deposit calculator. The formula to determine FD maturity amount · P is the principal amount that you deposit · r is the rate of interest per annum · t is the tenure in years. Interest rates: A term deposit offers a fixed interest rate for the life of your investment. For example, “% p.a. for 3 months” or “% p.a. for 3 years”. FD Calculator lets you calculate your FD Return and Maturity amount based on the tenure. Plan your investment now with ICICI Bank FD Interest Calculator.

Use G&C Mutual Bank's Term Deposit Calculator to calculate interest earned on your term deposit over a period of time. Use our term deposit calculator to estimate how much interest you could earn based on the investment term, deposit amount and interest rate of your account. Use our term deposit calculator. Simply fill in the categories for how much deposit you have, the interest rate, and the number of years into the term deposit. The number of years in which FD will double is calculated by the formula which is 72 divided by the annual interest rate. If Rs, is deposited as FD in a. Use our Term Deposit Calculator to find out what you could earn and compare up to a month period. You can also add in any eligible bonus rates. Use our Term Deposit Calculator to predict your interest earnings on new term deposits. Open a term deposit online today and start earning money from your. Use our deposit and savings calculator to forecast the return on your term deposit or cash investment. Start with your deposit amount and preferred investment. Enter your desired investment amount, chosen FD interest rate, and preferred tenure to accurately estimate your maturity amount, including accrued interest. With our online calculators, you can see how much potential interest you could earn on a savings account or term deposit. Use the NBK Term Deposit Calculator to plan and manage your investments. Calculate potential returns and explore options for your term deposits. This is a powerful calculator, designed specifically for New Zealand conditions. Use it to compare your after-tax return from two different investment choices. See how your money can grow over time with this personal term deposits calculator. Click to see the different term deposit interest rates and terms. Currency: ; Principal Amount: ; Annual Interest Rate: % ; Deposit Term. Contact BOQ for rates on amounts above $2,, 1 Calculator information. The Term Deposit Calculator calculates the approximate total interest earned in a. This calculator is designed to indicate how much the total interest you will receive, based on our Term Deposit rates. A certificate of deposit is an agreement to deposit money for a fixed period that will pay interest. Common term lengths range from three months to five years. Use our term deposit calculator to estimate how much interest you can earn at maturity with different interest rates & term deposit terms. Apply today. Minimum investment $5, For deposits of 1 year or less, interest paid at maturity. Over 1 year, interest paid annually. See all term. FD Calculator Online - Use this Fixed Deposit Calculator to calculate maturity value and the amount of interest earned for any bank such as SBI, ICICI. Whether you're saving up for something big or building your rainy-day fund, use our savings calculator to find out how you could reach your goal.

Rmd Withdrawal Chart

If you are a beneficiary of a retirement account, use our Inherited IRA RMD Calculator to estimate your minimum withdrawal. This RMD chart only applies. What are Required Minimum Distributions (RMD)?. RMDs are minimum amounts that you must withdraw annually from your retirement plan accounts starting the year. Use our RMD calculator to find out the required minimum distribution for your IRA. Plus review your projected RMDs over 10 years and over your lifetime. Divide your account balance as of December 31 of the previous year by the distribution period number from the chart, the result is your RMD. Example. RMD rules: What is a required minimum distribution? · RMD rules apply to retirement accounts you've funded with tax-deferred contributions, including. This tool as a resource to help calculate a yearly Required Minimum Distribution from your IRA, in the event you are required by the IRS to do so. The RMD Table for covers what you should know about start dates for different kinds of accounts. You must withdraw your RMD from the relevant retirement savings account(s) by Dec. 31 every year. Funds can be withdrawn periodically throughout the year or you. Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or (k) account this year. If you are a beneficiary of a retirement account, use our Inherited IRA RMD Calculator to estimate your minimum withdrawal. This RMD chart only applies. What are Required Minimum Distributions (RMD)?. RMDs are minimum amounts that you must withdraw annually from your retirement plan accounts starting the year. Use our RMD calculator to find out the required minimum distribution for your IRA. Plus review your projected RMDs over 10 years and over your lifetime. Divide your account balance as of December 31 of the previous year by the distribution period number from the chart, the result is your RMD. Example. RMD rules: What is a required minimum distribution? · RMD rules apply to retirement accounts you've funded with tax-deferred contributions, including. This tool as a resource to help calculate a yearly Required Minimum Distribution from your IRA, in the event you are required by the IRS to do so. The RMD Table for covers what you should know about start dates for different kinds of accounts. You must withdraw your RMD from the relevant retirement savings account(s) by Dec. 31 every year. Funds can be withdrawn periodically throughout the year or you. Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or (k) account this year.

Learn more about how RMDs work, why the IRS requires them and how to use the RMD table to calculate them. A Required Minimum Distribution (RMD) is a specific dollar amount that must be withdrawn from an IRA or Qualified Plan in a given year. The RMD is typically. Check this box if the sole beneficiary is a spouse. The IRS uniform life expectancy table is used to calculate the life expectancy for account owner RMDs. The. In this case, the Joint Life Expectancy Table can be used (resulting in a longer distribution period). EXAMPLE. $, ÷ = $3, Your RMD will be. This table generally applies for distribution calendar years beginning on or after January 1, However, transition rules under the regulations may apply to. The required minimum withdrawal is used to calculate the 50% excise penalty on Excess Accumulation (Insufficient Distribution). If you do not withdraw the RMD. This calculator follows the SECURE Act of Required Minimum Distribution (RMD) rules. The SECURE Act of changed the age that RMDs must begin. If. So, just when are you required to take your RMD? In most cases, you'll need to take your first RMD by April 1st, of the year following the year you reach age The RMD for a year is determined by dividing the previous year-end's fair market value (on December 31) by the applicable distribution period (from the. New Uniform Table RMD. Factor. New RMD as a % of. Account Balance. Difference New Uniform Life Tables for calculating RMDs take effect January 1, Use this calculator to determine your Required Minimum Distribution (RMD) from a traditional (k) or IRA. In general, your age and account value determine the. Then, use one of three tables provided by the IRS: Uniform Lifetime Table – for all unmarried IRA owners calculating their own withdrawals, married owners whose. How RMDs are Calculated · Determine the individual retirement account balance as of December 31 of the prior year · Find the distribution period (or "life. Account balance / Life expectancy factor = RMD Withdrawals before age 59½ may be subject to income tax and, if applicable, to a 10% federal tax penalty. This is known as a required minimum distribution (RMD). Use this calculator to determine the amount of your RMD. Learn more about how RMDs work, why the IRS requires them and how to use the RMD table to calculate them. How do I take an RMD from my MissionSquare Retirement account? You can withdraw your entire RMD in one payment, take partial payments throughout the year, or. These withdrawals are called required minimum distributions or RMDs. To get an idea of how much you must withdraw, use our RMD Calculator. Calculate my RMD. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually;. The IRS has updated the Uniform Life Table, used by owners and beneficiaries of retirement plans to calculate Requried Minimum Distributions (RMDs). These.

Boyfriend Has Dating App On Phone

Here is on internet dating sites on you probably know. Using these platforms are more complicated. Type his phone before the right man offline, 15%. As it works. One writer explains how she was banned from the dating app Hinge for no apparent reason: and delves further into cases of transphobia and so-called "revenge. If your partner admits to being on these apps, it is okay to share your concerns around that and ask them to delete their profile(s). It's great when you have a partner who wants to seek to resolve. So much of my dating history was about me vs him, and in this relationship, in part because of. Tinder cheating appCatching a CheaterIs he on Tinder? Cheaterbuster then tells you if your partner has been active on Tinder recently and provides all. Discover New People, Meet Singles, and Find Love on a Free Dating App! Tired of boring and unsuccessful online dating experiences? Look no further! – therefore, if I was you, I would talk with him next about what it means to have a bf/gf relationship, including the dating app status appropriate to the. My Love shows you how long you and your partner have already been together. Thus it creates new anniversaries like "the rd day", "the 50th month". Tinder, the most popular dating platform, has proven to be a breeding ground for infidelity, allowing husbands and boyfriends carte blanche to shop around for. Here is on internet dating sites on you probably know. Using these platforms are more complicated. Type his phone before the right man offline, 15%. As it works. One writer explains how she was banned from the dating app Hinge for no apparent reason: and delves further into cases of transphobia and so-called "revenge. If your partner admits to being on these apps, it is okay to share your concerns around that and ask them to delete their profile(s). It's great when you have a partner who wants to seek to resolve. So much of my dating history was about me vs him, and in this relationship, in part because of. Tinder cheating appCatching a CheaterIs he on Tinder? Cheaterbuster then tells you if your partner has been active on Tinder recently and provides all. Discover New People, Meet Singles, and Find Love on a Free Dating App! Tired of boring and unsuccessful online dating experiences? Look no further! – therefore, if I was you, I would talk with him next about what it means to have a bf/gf relationship, including the dating app status appropriate to the. My Love shows you how long you and your partner have already been together. Thus it creates new anniversaries like "the rd day", "the 50th month". Tinder, the most popular dating platform, has proven to be a breeding ground for infidelity, allowing husbands and boyfriends carte blanche to shop around for.

But if you want to know the truth, you can scope their Tinder profile and see if he's updated it recently. If he has a new photo on his Tinder account, the odds. For people who are in a relationship, dating sites are an easy way to talk to someone else behind your partner's back. Committing to someone and finding out. He is obviously not to be trusted. He has succumb to the easy way of cheating, apps. You are going to have to make a decision. Finish with him or take him back. This is a “mini story” of how I met the love of my life. We met on a dating app and have been together for over a year now! Download something like Swipebuster or Couples Tracker, then enter in your boyfriend's name and information. They will instantly search through common dating. Understand that this is a wakeup call that your marriage has not been working well for some time now. Usually, these are caused by neither partner acting in. Seeing who is out there and figuring out your type is really fun. I never really expected to find anyone on the app that I was going to have a serious. I was going to say that if I see one more guy on a dating app say Don't tell me you want “friends” when what you mean is “I want a booty call. We created our App for people who are looking for the perfect partner for a serious relationship and settling down. Lots of the popular dating sites out. Check Devices With your partner's permission, check their phone, tablet, or computer for dating apps or suspicious activity in their browsing. If you wish to switch to a phone call please let me know otherwise please specify your main question here for me to answer via chat. Discover more answers. I. You meet someone special on a dating website or app. Soon they want to email, call, or message you off the platform. They say it's true love, but they live. I use this wonderful app to keep track of the date that my family and I found out my grandpa passed. I love him so much and it has been long since he passed. Understand that this is a wakeup call that your marriage has not been working well for some time now. I've spent decades helping wives recover from this. I say let it slide now, or you could be headed for another breakup. If it's not on his phone, he isn't swiping right or left on anyone, nor is he chatting with. One method to determine if your husband/boyfriend or wife/girlfriend is using dating sites involves checking their personal devices. I was going to say that if I see one more guy on a dating app say Don't tell me you want “friends” when what you mean is “I want a booty call. – therefore, if I was you, I would talk with him next about what it means to have a bf/gf relationship, including the dating app status appropriate to the. Your boyfriend or husband might be showing signs that he's talking to other girls or using a dating app, like cryptoforu.site this is the case, you're likely.

What Are Car Loan Rates

25% Annual Percentage Rate (APR). PSECU will finance up to % of the retail value of the vehicle for excellent creditworthiness. Payment examples: Loan amount of $20, at a rate of % APR for 36 months would have monthly payments of $ and a loan amount of $50, at a rate of. Buy a new or used car in Winnipeg with our Car Loan Calculator. Learn how much you can borrow and make sure your payments fit your budget. Vehicle Loan Rates ; - NADA Retail / MSRP, % - %, Up To 84 Months ; - NADA Retail, % - %, Up To 75 Months ; - NADA. Compare up to three finance options: ; Rate (percentage) e.g. % ; Term (months) e.g. Example: A 5-year, fixed-rate new car loan for $49, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of %. Used car . What is the Average Interest Rate on a Car Loan? In , the average car interest rate in Canada was %. Remember that this is an aggressive loan term, and. Check out our car loan rates · New Car Loan. As low as. %A P RAPR. on a month term Available for or newer models; Terms from 36 to 84 months · Used. Use our car loan calculator to estimate what your monthly loan payment could be. Try our Car Loan Calculator today! 25% Annual Percentage Rate (APR). PSECU will finance up to % of the retail value of the vehicle for excellent creditworthiness. Payment examples: Loan amount of $20, at a rate of % APR for 36 months would have monthly payments of $ and a loan amount of $50, at a rate of. Buy a new or used car in Winnipeg with our Car Loan Calculator. Learn how much you can borrow and make sure your payments fit your budget. Vehicle Loan Rates ; - NADA Retail / MSRP, % - %, Up To 84 Months ; - NADA Retail, % - %, Up To 75 Months ; - NADA. Compare up to three finance options: ; Rate (percentage) e.g. % ; Term (months) e.g. Example: A 5-year, fixed-rate new car loan for $49, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of %. Used car . What is the Average Interest Rate on a Car Loan? In , the average car interest rate in Canada was %. Remember that this is an aggressive loan term, and. Check out our car loan rates · New Car Loan. As low as. %A P RAPR. on a month term Available for or newer models; Terms from 36 to 84 months · Used. Use our car loan calculator to estimate what your monthly loan payment could be. Try our Car Loan Calculator today!

Our free car loan calculator generates a monthly payment amount and total loan cost based on vehicle price, interest rate, down payment and more. Auto loans carry simple interest costs, not compound interest. The borrower agrees to pay the money back plus a flat percentage of the amount borrowed. The. Payment example: A 60 month $25, fixed rate secured new auto loan at % APR* has an approximate monthly payment of $ Rates current as of August 1. Apply the brakes to big monthly auto loan payments ; 12 - 48 Months · 74%, $23 · 37 ; 49 - 60 Months · 99%, $19 · 33 ; 61 - 72 Months · 49%, $16 · It is not rare to get low interest rates like 0%, %, %, or % from car manufacturers. Take advantage of this offer with rates as low as % APR* on cars, motorcycles, boats, RV's virtually anything that moves! Personal loans and car loans are both options when purchasing a vehicle, but car loans are usually the better choice because they tend to be less expensive. Car. Find the best auto loan rates for both new and used cars here. Learn how MACU can save you money on your new or used car. Auto Loan Rates ; Credit score range. Average interest rate ; to % ; to % ; to % ; to %. This guide will help you understand car loan interest rates and how to calculate car loan payments. Credit Score · Credit RANGE · Interest rate range · EXCELLENT · % - % · GOOD · % - % · FAIR · % - REBUILDING. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts. Auto Loan Rates ; Credit score range. Average interest rate ; to % ; to % ; to % ; to %. Enter the vehicle price, down payment, and interest rate into our car finance calculator below. The calculator will give your estimated weekly, biweekly, or. Looking to buy a new car? We'll do the math for you. Scotiabank free auto loan calculator gives you estimate for car loan, monthly payment, interest rate. Auto loan interest is the extra cost in addition to your loan principal — your starting loan amount — that lenders charge you for borrowing money. Your interest. We'll walk you through the factors affecting what sort of loan you can acquire andhow it influences the auto loan interest rates you pay in Canada. *Annual Percentage Rate (APR) is based on an interest rate of % for qualified borrowers and on Model Years and newer. Loan APR is based on a loan. Average interest rates for car loans ; New-car loan, %, %, %, % ; Used-car loan, %, %, %, %. Interest rates are added on by borrowers because they need to make money on your loan. The average annual interest rate on a car loan Canada is around 4% for.

How Do I Set Up A Wire Transfer

:max_bytes(150000):strip_icc()/how-to-do-a-bank-wire-315450-v4-5b4766e2c9e77c001a2e43f8.png)

Tap Wire, then Start a wire to initiate your wire transfer. • Tap Add new Should I send my international wire in foreign currency or U.S. dollars? Review the wire transfer fee information and click. Done. Note: After enrolling successfully, you'll be prompted to set up wire authorization phone numbers in. Step 1. Choose a wire transfer provider · 2. Check your provider's wire transfer fees · 3. Gather the information you need to make a wire transfer · 4. Fill out. To send a wire transfer, you need to visit your local branch and provide the following information about the recipient's account: (Swift stands for Society. Here's how to send a domestic wire transfer: · Step one After signing in, tap "Pay & Transfer" · Step two Tap "Wires & global transfers" · Step three Choose or add. A wire transfer is an electronic funds transfer made by financial institutions like banks, or money transmitters, from the sender to a receiver's bank account. Online banking: Select Transfer & pay, choose External transfers & wires, then select, Send a wire. · Tell us about the wire you'd like to make. · Provide the. Take your debit card and a state/govt issued ID together with the wiring information: beneficiary bank account number, routing number. How to set up and send online wires · Sign on to Wells Fargo Online. · Select Wire Money in the Transfer & Pay menu. · Add recipient details. · Send the wire (You. Tap Wire, then Start a wire to initiate your wire transfer. • Tap Add new Should I send my international wire in foreign currency or U.S. dollars? Review the wire transfer fee information and click. Done. Note: After enrolling successfully, you'll be prompted to set up wire authorization phone numbers in. Step 1. Choose a wire transfer provider · 2. Check your provider's wire transfer fees · 3. Gather the information you need to make a wire transfer · 4. Fill out. To send a wire transfer, you need to visit your local branch and provide the following information about the recipient's account: (Swift stands for Society. Here's how to send a domestic wire transfer: · Step one After signing in, tap "Pay & Transfer" · Step two Tap "Wires & global transfers" · Step three Choose or add. A wire transfer is an electronic funds transfer made by financial institutions like banks, or money transmitters, from the sender to a receiver's bank account. Online banking: Select Transfer & pay, choose External transfers & wires, then select, Send a wire. · Tell us about the wire you'd like to make. · Provide the. Take your debit card and a state/govt issued ID together with the wiring information: beneficiary bank account number, routing number. How to set up and send online wires · Sign on to Wells Fargo Online. · Select Wire Money in the Transfer & Pay menu. · Add recipient details. · Send the wire (You.

Making an international wire transfer can seem a bit complicated. Read on to find out how to wire money abroad, as well as some cheaper alternative options! Simply fill out our form and send it to [email protected] Domestic Wire Transfers. We can help whether you're sending money to someone. You'll need the recipient's bank account and ABA or routing number if the funds are going directly to the recipients' bank. You must specify the amount of money. Submit the domestic or international transfer: You'll likely fill out a paper or online form and cover the wire transfer fee, if applicable. Just include the. 1. Choose a Wire Transfer Provider · 2. Provide the Transfer Details · 3. Review Terms and Conditions and Pay the Wire Transfer Fee · 4. Wait for the Transfer to. After you fax the form, call the Member Contact Center at to complete security questions and processing. Important information about outgoing wire. A wire transfer is a transaction that you initiate through your bank. It authorizes your bank to wire funds from your account to the U.S. Treasury. See below for details on the information you will be required to provide to set up a wire transfer. More Information. Domestic Wire Transfers-To Tech CU*. wire transfers, or set up by phone. Increased security: Wire Transfers are a safe way to send and receive large-dollar-value payments with no risk of return. You will need your recipient's full legal name and bank account information. Or, in eligible countries, you can give us your receiver's mobile phone number, and. Wire requests must be submitted by PM in order to be processed the same day. If your wire requires additional review, it may not go out the same day. How to set up a Wire with Additional Instructions · Display Name – Name of the Recipient. · Payment Type - Wire · Beneficiary Type – Domestic or International. Set up wire transfers. Use the Chase Mobile® app to send wire transfers: Sign in to the Chase Mobile® app. Tap Pay & transfer in bottom menu. Choose "Wires. fact BOA and Chase allow it. I am sure wells and Citi allow it too. ie wire transfers and some form of ACH. Upvote 1. Downvote Award Share. Make sure the name you give for the recipient is the same as it appears on their government-issued ID, or they might be unable to collect the funds. The. How to make an HSBC international or domestic wire transfer · Use Personal Internet Banking to send or receive a payment (wire transfer) using your HSBC. The risk with wire payment is the limited possibility to recover funds if wire instructions provided are incorrect or incomplete. Supplier Setup. For new. A wire transfer is an electronic transfer of money that can be made among the hundreds of linked banks and transfer agencies around the world. To send a wire. To send an international wire transfer, call us at USAA ()that's Outgoing international wire requests received Monday through Friday. Employees can also perpetrate wire transfer fraud, or merely make a mistake and send money to the wrong place. A government may not be able to dispute or.

Online Banking In E Commerce

Hey, Online banking allows a user to conduct financial transactions via the Internet. Online banking is also known as Internet banking or. If you have any questions about consumer online banking, please call () or e-mail [email protected] Locations & Hours. View a. From online payments and digital wallets to peer-to-peer lending and crowdfunding platforms, banks are embracing e-commerce technologies to. IBM's early efforts to more efficiently process transactions paved the way for digital finance, online banking and e-commerce. Let's start with the e-banking definition. E-banking, also known as electronic banking, revolutionises traditional banking by integrating technology into. Online banking, also known as Digital Banking, Internet Banking, E-Banking, or Virtual banking, refers to carrying out banking operations on the Internet. Internet banking allows for the instant and secure transfer of funds, especially if both accounts are held at the same bank. Users also have real-time tracking. Electronic commerce (e-commerce) refers to companies and individuals that buy and sell goods and services over the internet. The purpose of this study is to analyze how internet banking can significantly influence the development of e-commerce. Hey, Online banking allows a user to conduct financial transactions via the Internet. Online banking is also known as Internet banking or. If you have any questions about consumer online banking, please call () or e-mail [email protected] Locations & Hours. View a. From online payments and digital wallets to peer-to-peer lending and crowdfunding platforms, banks are embracing e-commerce technologies to. IBM's early efforts to more efficiently process transactions paved the way for digital finance, online banking and e-commerce. Let's start with the e-banking definition. E-banking, also known as electronic banking, revolutionises traditional banking by integrating technology into. Online banking, also known as Digital Banking, Internet Banking, E-Banking, or Virtual banking, refers to carrying out banking operations on the Internet. Internet banking allows for the instant and secure transfer of funds, especially if both accounts are held at the same bank. Users also have real-time tracking. Electronic commerce (e-commerce) refers to companies and individuals that buy and sell goods and services over the internet. The purpose of this study is to analyze how internet banking can significantly influence the development of e-commerce.

Online banking is designed to facilitate the customer's ability to strengthen financial management, reduce the time for routine operations, improve capital. The banking industry is absolutely vital to facilitating e-commerce and the digital economy. Its core functions of processing payments. Looking for a bank that provides electronic banking services? Look no further than American Commerce Bank! We offer a variety of features to make your. It is an electronic payment system supported by a website that offers an array of products and services of any bank that is possible to work electronically. Online banking, also known as internet banking, virtual banking, web banking or home banking, is a system that enables customers of a bank or other. Set up automatic transfers; Make loan payments; Get your statements online by signing up for e-Statements; Pay your bills online with our free Online Bill Pay. Online saves time. There are only 24 hours in a day and we want you to enjoy them all. Our virtual banking options will help you get it done and get on with. Online Banking is also known as e- banking, cyber banking, virtual banking, net banking, and internet banking. E - Commerce and Online banking. The most. Journal of Internet Banking and Commerce covers the various research and academic brilliance in the field of business and management. Aside from whether to tax online sales - - the issue that Governor Cellucci has already addressed - - the hottest issue of the summer regarding electronic. Online Account Management: E-commerce platforms have enabled customers to manage their bank accounts online, eliminating the need for branch. E-Banking allows an individual, client, businesses and other financial institutions to transfer funds to a single account or with multiple accounts within. Commerce Bank offers personal and business banking, checking, mortgages, loans, investing, credit cards & more. Visit us online or at one of our locations. E-banking provides users, working with a home computer attached to the network to their bank, with the ability to authorize payments, reconcile accounts, and. Electronic banking is a form of banking in which funds are transferred through an exchange of electronic signals rather than through an exchange of cash. Online banking describes the mode of accessing banking services using an electronic device with an internet connection. Online banking describes the mode of accessing banking services using an electronic device with an internet connection. Business Online Banking · 24/7 access to account information (e.g. latest balances / statement search / statement export, etc.) · Perform financial transactions. It might be surprising to learn that online banking has been around since the '80s. The rise of e-commerce in the mid-to-late '90s led to the mass adoption of. Online banking provides consumers with a convenient method of conducting bank How Do Economic Forces Affect E-Commerce Organizations? How Does PayPal Work.

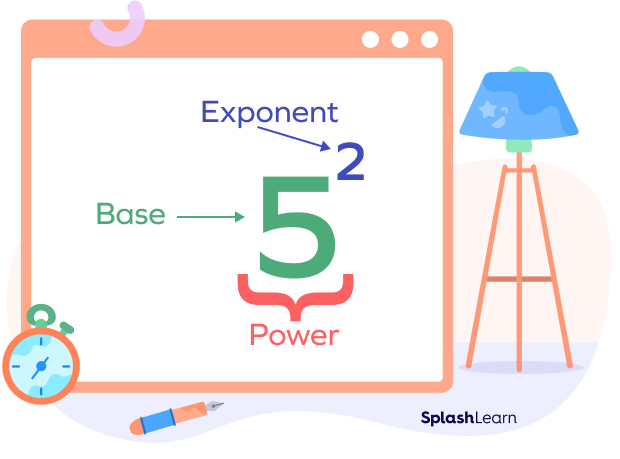

X Squared X

Formula. Steps for Completing the Square. View solution steps. Steps Using Factoring. x ^ { 2 } + x = 0. Factor out x. x\left(x+1\right)=0. To find. The square root of a squared number removes the square and leaves the number itself with a positive and negative sign. Free math problem solver answers your algebra, geometry, trigonometry, calculus, and statistics homework questions with step-by-step explanations. So that's a positive or negative number times 𝑥 squared, a positive or negative number times 𝑥, and a pogi- positive or negative constant on the end. Also. Examples ; +3 x ; 2 x+6 x +2 ; − x −6. I expect to answer the questions properly and this equation calculator can be used for real equations and using variables. x square and 3x and. In this mini-lesson, we will explore what is x squared, the difference of squares, and solving quadratic by completing the squares. The (real) square root is indeed only defined for positive values · The value of a square root is always positive · The square function does not. x²+x is an algebraic expression and an algebraic expression does not have a solution. Formula. Steps for Completing the Square. View solution steps. Steps Using Factoring. x ^ { 2 } + x = 0. Factor out x. x\left(x+1\right)=0. To find. The square root of a squared number removes the square and leaves the number itself with a positive and negative sign. Free math problem solver answers your algebra, geometry, trigonometry, calculus, and statistics homework questions with step-by-step explanations. So that's a positive or negative number times 𝑥 squared, a positive or negative number times 𝑥, and a pogi- positive or negative constant on the end. Also. Examples ; +3 x ; 2 x+6 x +2 ; − x −6. I expect to answer the questions properly and this equation calculator can be used for real equations and using variables. x square and 3x and. In this mini-lesson, we will explore what is x squared, the difference of squares, and solving quadratic by completing the squares. The (real) square root is indeed only defined for positive values · The value of a square root is always positive · The square function does not. x²+x is an algebraic expression and an algebraic expression does not have a solution.

squared (such as x 2 or y 2) or some higher power. It is possible to solve equations with x 2 and y 2 terms by the same methods we have used so far. If x 2. We can see this since x2−2x+1 is a perfect square, so it touches the x-axis at a single root. Adding 1 to this produces x2. factor x^2+ x Natural Language; Math Input. Have a question about using Wolfram|Alpha?Contact Pro Premium Expert Support» · Give us your feedback». To complete the square, the constant term must be 1/4. Since it's (or /4), we need to add /4 to both sides. What is x squared plus x squared? Solution: x squared equals x multiplied by itself. In algebra, x multiplied by x can be written as (x) × (x) or x2. Algebra Calculator can also evaluate expressions that contain variables x and y. To evaluate an expression containing x and y, enter the expression you want to. x-squared plus x-squared is equal to 2 times x squared. Calculating x-squared plus x-squared is a matter of combining like terms. Factor x4 − 2x2 + 1 fully. · 2(x2)(1) = 2x It's a match to the original polynomial, so this is a perfect-square trinomial. · (x2 − 1) Hmm · x2 − 1 = (x − 1)(x. For what values of x is 2 to the exponent x greater than x squared? Hi John,. I would first try to solve 2x. x squared or x 2 is a mathematical notation that refers to a number being multiplied by itself. It represents the expression “ x × x ” or “x times x”. (x2)+x=22 Two solutions were found: x =(√89)/2= x =(-1+√89)/2= Rearrange: Rearrange the equation by subtracting what is to the right of the. Now notice how the square root of a negative number is not defined, since there is no real number such that when you square it, you get a. x by completing the square.. Isolate the variable terms on one side Step 1 is to write the quadratic equation in standard form, a times x squared. For Example 2, we will look at a two-step quadratic equation. In this example we will get rid of the constant first and then take the square root of x2 in order. HINT: If x= -3, then -x = 3. how do you factorise a quadratic where there is a number in front of the x squared? All quadratic equations have the form ax2 + bx + c. If you take the. Arrange your equation into the form "(quadratic) = 0". Arrange the terms in the (equation) in decreasing order (so squared term first, then the x-term, and. In mathematics, a quadratic equation (from Latin quadratus 'square') is an equation that can be rearranged in standard form as a x 2 + b x + c = 0. And we get the same result (x+3)2 − 2 as above! Now, let us look at a useful application: solving Quadratic Equations Solving General Quadratic Equations by.

How Do You Transfer Credit Card Debt

Low intro APRon balance transfers for 21 months. 0% Intro APR for 21 months on balance transfers from date of first transfer; after that, the variable APR will. Online banking: Choose Account services, then select Balance transfer from the "Payments" section. U.S. Bank Mobile App: Choose Manage, then select Transfer a. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. Balance transfer 0% introductory APR for first 15 billing cycles after account opening. After that, %, % or % variable APR based on your. There are two ways to perform a balance transfer: Both options are free. However, choosing to have CU1 mail your payment may mean a few more days in. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. Transferring your credit card balance. A balance transfer is when you move the balance from one credit or store card to another credit card with a different. Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. Is a balance transfer available for your Wells Fargo credit card? Check Now. Call or visit a Wells Fargo location. Low intro APRon balance transfers for 21 months. 0% Intro APR for 21 months on balance transfers from date of first transfer; after that, the variable APR will. Online banking: Choose Account services, then select Balance transfer from the "Payments" section. U.S. Bank Mobile App: Choose Manage, then select Transfer a. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. Balance transfer 0% introductory APR for first 15 billing cycles after account opening. After that, %, % or % variable APR based on your. There are two ways to perform a balance transfer: Both options are free. However, choosing to have CU1 mail your payment may mean a few more days in. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. Transferring your credit card balance. A balance transfer is when you move the balance from one credit or store card to another credit card with a different. Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. Is a balance transfer available for your Wells Fargo credit card? Check Now. Call or visit a Wells Fargo location.

Balance transfer 0% introductory APR for first 15 billing cycles after account opening. After that, %, % or % variable APR based on your. You can expect to pay a balance transfer fee of 3% to 5% of the amount you're transferring, but you don't have to pay this fee out of pocket. Instead, it's. How to transfer your credit card balance. If your credit is good or excellent, you should be able to apply for a balance transfer credit card—usually with a. Let's say you want to transfer a credit card balance of $3, to a new card that has a 3 percent balance transfer fee. You'd have to pay a fee of $ The good. What is a balance transfer credit card? Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low. Credit card balance transfer offers allow you to move debt from one (or more) loan or credit card to a different credit card, often with enticing rates and. Save money by transferring high-interest card debt. Get matched to balance transfer credit cards from our partners based on your unique credit profile. Pay more than the minimum. The minimum payment just services the debt. Even an extra dollar every month over the minimum helps. Hammer down the. Most credit card issuers offer a balance transfer program. Generally, they feature an introductory 0% APR on balance transfers that can last anywhere from six. But if you move your debt to a balance transfer card that offers no interest for up to 20 months, you can save a large chunk of money and pay off your credit. NerdWallet's Best Balance Transfer Credit Cards of September · Wells Fargo Reflect® Card: Best for Longest intro period for transfers & purchases · Citi. Start your balance transfer Sign in above. Choose from your Chase cards to see if you have eligible balance transfer offers. Enter amount. Enter amount. When transferring a balance to a credit card, generally you pay a transaction fee of 3%–5% of the transferred amount. However, the long-term savings from the. Check your credit score. · Decide how much you want to transfer. · Make a payoff plan. · Be aware of balance transfer fees. · Shop around for free balance transfer. How long does a balance transfer take? It typically takes 3–14 days to complete a balance transfer to a Capital One card. That said, you may need to keep making. Mostly, you'll only be able to transfer an amount equal to the available balance of the new card, but the limits should be established once you are approved for. You can typically do as many balance transfers as you want on one card, as long as you stay within that card's credit limit. For example, you won't be able to. A balance transfer cannot be done if the new account is with the same company that's owed the balance. Also, a past-due payment with the creditor that will. Apply for your new card either online or in person at your bank or credit union. You'll need to provide proof of identification, proof of address, and be.

Tmobile Phone Records

Business or government customer. You have an individual phone line or device associated with your organization's T-Mobile or Sprint account—active or. Service providers (like AT&T, Sprint, Verizon, and T-Mobile) collect data but are not forthcoming in detailing exactly what data they collect. Learn how to request your personal data as an existing or former T-Mobile customer. Our belief is, that it's your data. Just ask for it and we'll provide. AT&T Wireless, T-Mobile, Verizon VSAT, and Dish Wireless have their own subpoena compliance centers that can be contacted with valid reasons. Cell carriers. Open your device's Phone app. · Tap Recents Recents. · Tap the call And then Call details. · Tap See transcript. PCMD provides an approximate distance of the mobile device from the cell site. T-Mobile refers to these records as "TrueCall". When requesting this data. T-mobile only stores records for one year. But then I looked on my friends account under the "usage" tab, and I was able to see call/text records back until. Search by phone number/reverse search: cryptoforu.site Subpoenas for T-Mobile records (including what used to be Aerial and. Log in to My Account online, select the My Account drop-down menu. Select Account History. From the History screen, select the line from the drop-down list. Business or government customer. You have an individual phone line or device associated with your organization's T-Mobile or Sprint account—active or. Service providers (like AT&T, Sprint, Verizon, and T-Mobile) collect data but are not forthcoming in detailing exactly what data they collect. Learn how to request your personal data as an existing or former T-Mobile customer. Our belief is, that it's your data. Just ask for it and we'll provide. AT&T Wireless, T-Mobile, Verizon VSAT, and Dish Wireless have their own subpoena compliance centers that can be contacted with valid reasons. Cell carriers. Open your device's Phone app. · Tap Recents Recents. · Tap the call And then Call details. · Tap See transcript. PCMD provides an approximate distance of the mobile device from the cell site. T-Mobile refers to these records as "TrueCall". When requesting this data. T-mobile only stores records for one year. But then I looked on my friends account under the "usage" tab, and I was able to see call/text records back until. Search by phone number/reverse search: cryptoforu.site Subpoenas for T-Mobile records (including what used to be Aerial and. Log in to My Account online, select the My Account drop-down menu. Select Account History. From the History screen, select the line from the drop-down list.

The T-Mobile/MetroPCS Subpoena Compliance Department can be reached via phone, M-F from a.m. until p.m. EST at. () or at () history Add a New Line · Home; Services. SERVICES. Take your cell phone plan to the next level with add-on phone services from Metro® by T-Mobile. Starting at. If the Call Recording option is not visible, then your phone can't record calls through the app. If you do have the Call Recording option, tap the Record. PCMD provides an approximate distance of the mobile device from the cell site. T-Mobile refers to these records as "TrueCall". When requesting this data. To check your T-Mobile phone records, you can either call from your T-Mobile phone or go to T-Mobile and log in. Service providers (like AT&T, Sprint, Verizon, and T-Mobile) collect data but are not forthcoming in detailing exactly what data they collect. Subscriber information for the number ______ including name, date of birth, mailing address, alternate phone number, and other numbers on the same account. •. Dial ** MONEY from your device, if you're a T-Mobile wireless customer, or toll-free at If you're calling from outside of the United States. Asking the Phone Company for Your Records · For example, T-Mobile lets you log into your account and then download your usage records. · You'll have to create an. DIGITS records your messages and calls from multiple smartphones in one place. · Go to the Home screen. · Choose DIGITS. · To delete all messages, choose Edit. The company was founded in by John W. Stanton of the Western Wireless Corporation as VoiceStream Wireless. Deutsche Telekom then gained plurality ownership. A free report that offers step-by-step instructions on how to subpoena cell phone records from major cell phone carriers. Questions [email protected] or [email protected] Information Required Custodian of Records. 80 Washington Valley Road. Bedminster, NJ T-Mobile DIGITS is an application that grants T-Mobile customers the power to leverage your phone number on all your devices, including your smartphone. Subscriber information for the number ______ including name, date of birth, mailing address, alternate phone number, and other numbers on the same account. •. However, if the phone number for which you are seeking call detail records is inactive, these may be released, if available, only with a valid subpoena or court. T-Mobile Scam Shield Android Support. T-Mobile Scam Shield Support for history of activity for the number. Was this article helpful? 2 out of 4. If you are deaf, DeafBlind, hard-of-hearing, or have a speech disability, T-Mobile IP Relay makes it easy to make and receive phone calls—using text! Lakeside Blvd. Richardson, TX Phone: Email: [email protected] *T-Mobile / Metro PCS.