cryptoforu.site News

News

How To Raise My Credit Score Quickly

Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close unused. Consider a secured credit card; Look into a credit-builder loan; Find a co-signer; Become an authorized user; Don't overspend. Consider. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an. The single most important way to improve your credit score is by paying your credit cards, installment loans, and any other credit line on time. Even if you don't have a credit card, you can ask that utility bills or other regular bill payments be added to your credit report. For fixed-rate loans, such. More tips on how to fix your FICO Score & maintain good credit: · If you have been managing credit for a short time, don't open a lot of new accounts too rapidly. How to raise your credit score quickly · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate information on your credit. Honestly, there are few fast fixes with credit. However, one thing that can work quickly, is paying down credit card balances. If you have high. Pay down your highest interest credit cards first, leave yourself some money, even a small amount for any possible shortfalls that you might. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close unused. Consider a secured credit card; Look into a credit-builder loan; Find a co-signer; Become an authorized user; Don't overspend. Consider. What actions you can take to boost your credit scores? · Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an. The single most important way to improve your credit score is by paying your credit cards, installment loans, and any other credit line on time. Even if you don't have a credit card, you can ask that utility bills or other regular bill payments be added to your credit report. For fixed-rate loans, such. More tips on how to fix your FICO Score & maintain good credit: · If you have been managing credit for a short time, don't open a lot of new accounts too rapidly. How to raise your credit score quickly · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate information on your credit. Honestly, there are few fast fixes with credit. However, one thing that can work quickly, is paying down credit card balances. If you have high. Pay down your highest interest credit cards first, leave yourself some money, even a small amount for any possible shortfalls that you might.

How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. That means paying down outstanding debt is one of the most effective ways to raise your credit score quickly. My Info © Opportunity Financial, LLC. One of the easiest ways to improve your credit score is by paying your bills on time every month. This will start to eliminate your credit card debt. Your. A higher score (especially above ) may give you more options — and better rates — if you ever need a car loan, mortgage, or home equity line of credit. 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. How to increase your credit score quickly: · ✓ Amend any errors · ✓ Remove any previous financial connections · ✓ Get started with Loqbox* · ✓ Keep your debts low. What are some quick ways to boost my credit score/ · As long as you can act fast..,. · Pay Down Your Bill On Time. · Keep Your Interest Low. · Hire. 1. Lower Your Credit Utilization Ratio. Each line of credit you have has a maximum amount. The percentage of that that you've charged is your credit. Good credit takes time to build. Overdoing it at first by applying for numerous credit cards all at once might damage your credit scores right from the start. Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. · Pad out a thin credit. Need to boost your credit score? These 4 programs can help (for free) · 1. Experian Boost · 2. TurboTenant Rent Reporting · 3. UltraFICO · 4. Grow Credit. How to improve your credit scores: 7 tips that can help · Monitoring your credit can give you an idea of your creditworthiness. · Making payments on time, keeping. Diversify Your Credit Having a strong credit mix can enhance your score. That means having credit cards, personal loans, auto loans, student loans, and/or a. Pay down credit card debt. If high credit card debt is weighing on your score, paying off all or most of it in one swoop could give your score a quick and. Experian Boost is an easy way for you to take control of your credit and build long-term credit health—just by paying your bills. Beware of credit-repair scams. Sometimes doing it yourself is the best way to repair your credit. The Federal Trade. Commission's “Credit. Repair: How to Help. Quick Loan Shopping If you have bad credit and can't find any other way to improve your score, you could consider taking a “quick loan.” These are typically. Honestly, there are few fast fixes with credit. However, one thing that can work quickly, is paying down credit card balances. If you have high. 1. Request a Copy of Your Credit Report · 2. Pay Off All Outstanding Collections · 3. Make All Future Payments On Time · 4. Reduce the Balances on Your Credit.

How Much Is A 15 Year Fixed Mortgage

Additionally, the current national average year fixed mortgage rate decreased 2 basis points from % to %. The current national average 5-year ARM. The combined effect of the faster amortization and the lower interest rate means that borrowing the money for just 15 years would cost $79,, compared to. Today's Year Mortgage Rates As of September 2, , the average year fixed mortgage APR is %. Terms Explained. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. A year mortgage will typically have lower interest rates, but a higher monthly payment. A year mortgage can save you quite a bit of money in interest. Rates on year mortgages are usually lower than year mortgage rates, which means you can save a lot by simply choosing a year loan term. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year. year fixed rate:APR %. %. Today. %. Over 1y. 5 Showing: Purchase, Good (), year fixed, Single family home, Primary residence. Introduction to Year Fixed Mortgages ; 15 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. Additionally, the current national average year fixed mortgage rate decreased 2 basis points from % to %. The current national average 5-year ARM. The combined effect of the faster amortization and the lower interest rate means that borrowing the money for just 15 years would cost $79,, compared to. Today's Year Mortgage Rates As of September 2, , the average year fixed mortgage APR is %. Terms Explained. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. A year mortgage will typically have lower interest rates, but a higher monthly payment. A year mortgage can save you quite a bit of money in interest. Rates on year mortgages are usually lower than year mortgage rates, which means you can save a lot by simply choosing a year loan term. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year. year fixed rate:APR %. %. Today. %. Over 1y. 5 Showing: Purchase, Good (), year fixed, Single family home, Primary residence. Introduction to Year Fixed Mortgages ; 15 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %.

Additionally, the current national average year fixed mortgage rate decreased 2 basis points from % to %. The current national average 5-year ARM. Graph and download economic data for Year Fixed Rate Mortgage Average in the United States (MORTGAGE15US) from to about year. Refinance ; year fixed mortgage · % · % ; year fixed mini mortgage · % · %. Refinance ; year fixed mortgage · % · % ; year fixed mini mortgage · % · %. The average APR on a year fixed-rate mortgage fell 1 basis point to % and the average APR for a 5-year adjustable-rate mortgage (ARM) rose 1 basis point. Current year mortgage rates may look favorable, but you'll have to live with the terms of the contract for a long time. It's always best to analyze it in. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. A year mortgage rate specifically is the annual rate of interest you can expect to pay on a mortgage that lasts 15 years. The average interest rate for a year loan was % as of June 22, Mortgage rates are near record lows right now for all loan types, making it a great. current actual value, an historical data chart and related indicators for Year Fixed Rate Mortgage Average in the United States - last updated from the. Year Fixed Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. A year fixed mortgage helps borrowers save on interest and pay off their home loan faster. Looking for a fixed interest rate and a shorter loan term? A A year fixed mortgage is a type of home loan with a fixed interest rate and a repayment plan spanning 15 years. As a popular option for first-time homebuyers. A year fixed mortgage is a loan with a repayment period of 15 years and an interest rate that remains the same throughout the life of the loan. At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Here's how their refinance options. What are the requirements of a Year Mortgage? To qualify for a Year Mortgage, you'll need to make a down payment of at least three to five percent of the. Current year mortgage rates are averaging around %. But keep in mind, your rate will depend on many financial factors. For today, Wednesday, September 04, , the national average year fixed refinance interest rate is %, down compared to last week's of %. The. The current average interest rate on a year fixed-rate mortgage decreased 11 basis points from the prior week to %. For context, a year fixed-rate.

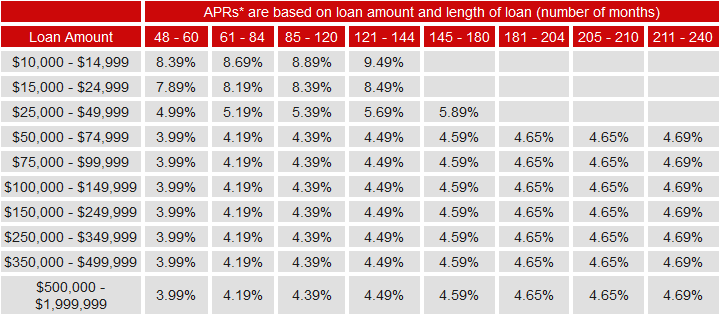

Good Credit Interest Rate Car Loan

Typically, the higher your credit score, the lower your interest rate will be. That's because a high credit score indicates that you have a good history of. Credit score—Generally, you can get a lower interest rate on your auto loan if you have a higher credit score. · Debt-to-income ratio—These numbers determine. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. The average ranges from 3% to % for new cars—partly because new car buyers tend to have better-than-average credit. interest rate if you have good credit. Loan rates and terms are determined by overall credit history and are subject to change without notice. Applications are subject to credit approval. Monthly. Car loans usually have APRs between 3% and 7%, while personal loans have a much bigger range of possible rates, at 6% to 36%. Another major difference between. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. The average interest rate on a new car loan with a credit score of is %, while the average interest rate on a used car loan is %. What kind of. LightStream - Used car purchase loan. · % ; Consumers Credit Union - Used car purchase loan. · % ; Alliant Credit Union – Used car. Typically, the higher your credit score, the lower your interest rate will be. That's because a high credit score indicates that you have a good history of. Credit score—Generally, you can get a lower interest rate on your auto loan if you have a higher credit score. · Debt-to-income ratio—These numbers determine. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. The average ranges from 3% to % for new cars—partly because new car buyers tend to have better-than-average credit. interest rate if you have good credit. Loan rates and terms are determined by overall credit history and are subject to change without notice. Applications are subject to credit approval. Monthly. Car loans usually have APRs between 3% and 7%, while personal loans have a much bigger range of possible rates, at 6% to 36%. Another major difference between. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. The average interest rate on a new car loan with a credit score of is %, while the average interest rate on a used car loan is %. What kind of. LightStream - Used car purchase loan. · % ; Consumers Credit Union - Used car purchase loan. · % ; Alliant Credit Union – Used car.

Average Credit Score for New Car, Annual Percentage Rate, Average Credit Score for Used Car ; , %, ; , %, ; , %. The average interest rate for a car loan is higher if you have bad credit than if you have a good credit score. But again, there is no minimum credit score for a car loan. Even people with bad credit can get a car loan, which is discussed in the article “How to Get a Car. The average interest rate on a three-year car loan is between 3% and %. The most important thing for you to remember is you'll want to obtain an average to. Borrowers with favorable credit scores — or higher — generally qualify for auto loans with the most attractive terms. · If your credit score is on the lower. The best interest rate on a car loan will always be 0% APR. This means you only pay back the amount of money you borrow to cover the cost of the car, and no. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. However, an average interest rate on a car loan for people with bad credit has been %. What Is a Good Interest Rate on a Car Loan? Of course, the lower. With three-year car loans, the average interest rate is around 3% to %. However, you may get a different interest rate because of your credit score. Want to. Average interest rates for car loans ; , , , ; New-car loan, %, %, %, %. Rates as of Sep 02, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. New and Used Car Loan Interest Rate by Credit Score ; , %, , % ; , %, , %. Average Used Auto Loan Rate for Excellent Credit. Credit Score, Interest Rate. or higher, %. Credit score range. Average interest rate ; to % ; to % ; to % ; to %. Car loans usually have APRs between 3% and 7%, while personal loans have a much bigger range of possible rates, at 6% to 36%. Another major difference between. This auto loan tool takes into account your credit score, current interest rates, and the term length of the loan to determine how much you'll pay per month. If you have excellent credit ( or higher), the average auto loan rates are % for a new car and % for a used car. Auto Loans and Rates · Special Interest Rate Discount! · Car loan rates as low as % APR* · 5-Year Auto Loan · Apply for a Car Loan. loan and a good interest rate. In this article, you will learn: How your credit score affects your eligibility for a car loan; Car loan rates by credit score. In general, the higher your credit score, the lower the rate on your auto loan. · Your credit score depends on things like your payment history, how much you owe.

Best Motorhome Interest Rates

What is a good interest rate for an RV loan? Our current rates for RV loans range from Rates Between % and % based on several factors, such as the. With approved credit. Floor rates apply – RV as low as % APR. See current rates. Not all borrowers will qualify for best rate. Rates are current as of. RV Loans ; Product. New Recreational Vehicles ; APR*. % ; Max Term^. months ; Rate Type. Fixed. Today's mortgage rates · Refinancing When you're ready to buy, your U.S. Bank RV financing pre-approval is good at any of our participating dealerships. to 9% for depending on term and amount financed is pretty common. The absolute worst I've seen in the last 30 days is 22%. In your best interest. Account Login. Sign into Star One Online Banking. For Lower the interest rate on a current Star One car loan. Optional. With fixed rates as low as % APR, our competitive RV interest rates can help you comfortably purchase the motorhome, camper or travel trailer of your choice. Rates start at % APR1. Get a National Parks Pass when your loan closes2! Up to % Financing. No Application Fees. Terms. The typical RV loan interest rates can vary widely depending on factors such as the borrower's credit score, the loan term, the lender, and the prevailing. What is a good interest rate for an RV loan? Our current rates for RV loans range from Rates Between % and % based on several factors, such as the. With approved credit. Floor rates apply – RV as low as % APR. See current rates. Not all borrowers will qualify for best rate. Rates are current as of. RV Loans ; Product. New Recreational Vehicles ; APR*. % ; Max Term^. months ; Rate Type. Fixed. Today's mortgage rates · Refinancing When you're ready to buy, your U.S. Bank RV financing pre-approval is good at any of our participating dealerships. to 9% for depending on term and amount financed is pretty common. The absolute worst I've seen in the last 30 days is 22%. In your best interest. Account Login. Sign into Star One Online Banking. For Lower the interest rate on a current Star One car loan. Optional. With fixed rates as low as % APR, our competitive RV interest rates can help you comfortably purchase the motorhome, camper or travel trailer of your choice. Rates start at % APR1. Get a National Parks Pass when your loan closes2! Up to % Financing. No Application Fees. Terms. The typical RV loan interest rates can vary widely depending on factors such as the borrower's credit score, the loan term, the lender, and the prevailing.

Typical RV loan terms range from 6 to 20 years and usually require a 10%% downpayment to purchase. At Southeast Financial, we typically offer loans with 0%. Rates starting at %. Looking for a motorcycle, boat, or RV? We offer loans for most types of recreational vehicles. You can finance up to % of the. Otherwise, depending on your credit score, the type of loan, the lender, loan term, and down payment, you could expect to pay interest rates as high as 17%. Currently, average RV loan rates for customers with a good credit score ranges from % to %. Therefore, expecting a higher interest rate is fair if you. Rates start at % APR1. · Get a National Parks Pass when your loan closes2! · Up to % Financing. · No Application Fees. · Terms up to Months3. Recreational vehicle (RV) loan. Finance your home away from home. For the best rates Pick a variable rate and pay less interest if rates drop*. Take a payment. The interest rate and length of your loan will vary depending on your credit score, income, and loan amount. Are the loan rates the same for all RVs? No, rates. Compare Alliant for RV loan rates ; %, months ; %, months ; %, months ; %, months. Loan rates and terms are determined by overall credit history and are subject to change without notice. Applications are subject to credit approval. Monthly. RV Rates ; Age of Vehicle or newer ; Loan Term months ; Interest Rate% ; Terms See Terms. As of September , the best interest rates for RV loans typically start around %. Of course, these rates fluctuate with market conditions, inflation, and. We make it easy to finance that motorhome, fifth wheel, toy hauler, camper For the most current information on RV loan interest rates, it's best to. **Rates as low as % APR for up to 72 months on new and used RV and Boat purchases, and refinances. Monthly payments per $1, for up to 72 months at %. Best RV Loans of · Best for Poor Credit: My Financing USA · Best Credit Union: NASA Federal Credit Union · Best for Large Used Loans: Southeast Financial. RV Loan Rates ; 60 Months · % · $10, ; 90 Months · % · $30, ; Months · % · $40, ; Months · % · $50, New/Used RV & Motor Home Fixed Rates ; up to 36 months, % ; months, % ; months, % ; months, % ; months, %. Old RV Payment Example: A month used RV loan (model years and older) with an annual percentage rate (APR) of % would have monthly payments of. Rates (APRs) listed are our best rates for the terms outlined. Your rate may be higher depending on credit history and underwriting criteria. Rates and. RV loans ; New or used boat or RV ; New boat or RV (), %, % ; New boat or RV (), %, % ; New RV (), %, %. Current Recreational Vehicle Rates ; Months · $ / per $1,, $3, ; Months · $ / per $1,, $3, ; Months · $ / per.

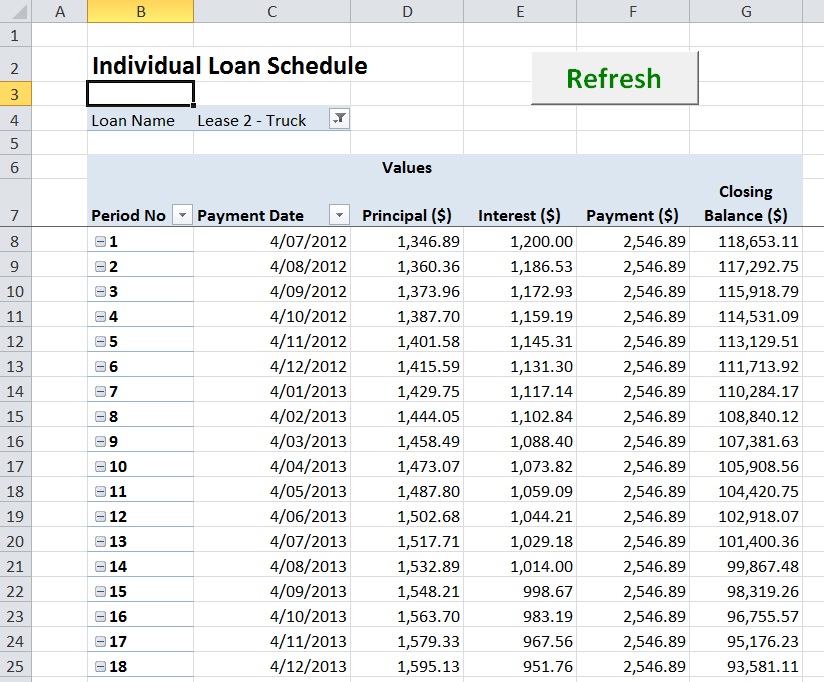

How To Figure Amortization Schedule

Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. The amortization schedule shows how your monthly mortgage payment is split between interest and principal over the duration of the loan. Most of your payment. To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know your interest fee for your. This calculator will compute a loan's payment amount at various payment intervals — based on the principal amount borrowed, the length of the loan and the. Use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan. The mortgage amortization calculator can display the composition of your loan's principal and interest as either a total breakdown or as a snapshot of specific. Create an amortization schedule payment table for loans, car loans and mortgages. Enter loan amount, interest rate, number of payments and payment frequency. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. Simply put, an amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Amortization. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. The amortization schedule shows how your monthly mortgage payment is split between interest and principal over the duration of the loan. Most of your payment. To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know your interest fee for your. This calculator will compute a loan's payment amount at various payment intervals — based on the principal amount borrowed, the length of the loan and the. Use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan. The mortgage amortization calculator can display the composition of your loan's principal and interest as either a total breakdown or as a snapshot of specific. Create an amortization schedule payment table for loans, car loans and mortgages. Enter loan amount, interest rate, number of payments and payment frequency. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. Simply put, an amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Amortization.

Use the amortization functions (menu items 9, 0, and A) to calculate balance, sum of principal, and sum of interest for an amortization schedule. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. To use our amortization calculator, type in a dollar figure under “Loan amount.” Adjust “Loan term,” “Interest rate” and “Loan start date” to customize the. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. If you know these three things, you can use Excel's PMT function. Amortizing Loan Calculator. Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly. Our mortgage amortization table shows amortization by month and year. How to calculate amortization. In order to make an amortization schedule, you'll need to. Amortizing Loan Calculator. Enter your desired payment - and the tool will calculate your loan amount. Or, enter the loan amount and the tool will calculate. In addition, the calculator allows you to input extra payments (under the “Amortization” tab). This can help you decide whether to prepay your mortgage and by. An amortization schedule calculator can help homeowners determine how much they owe in principal and interest or how much they should prepay on their. A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time. Figure out how to calculate your mortgage amortization. Guide to Amortization formula, here, we discuss its uses, practical examples, and Calculator with a downloadable Excel template. Use this Amortization Schedule Calculator to estimate your monthly loan or mortgage repayments, and check a free amortization chart. Amortization schedules use columns and rows to illustrate payment requirements over the entire life of a loan. Looking at the table allows borrowers to see. Month → In the first column, we'll enter the first month number, add one to it in the column below, and then drag the formula down until we reach our total. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. Amortization Calculator. This is a simple calculator that shows you the balance of your loan over the length of the loan. It also shows you what amount of your. Examine your principal balances, determine your monthly payment, or figure out your ideal loan amount with our amortization schedule calculator. Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Create a printable amortization schedule, with dates and subtotals, to see how much principal and interest you'll pay over time.

Getting A Cosigner For A Personal Loan

You can cosign just about any type of loan, including student loans, auto loans, home improvement loans, personal loans, credit card agreements, and mortgage. If you're under 18 years old: We welcome you to apply for a Start Personal Loan, as long as you have a parent or other co-signer on your loan. Parents will have. Adding a co-signer to your loan application can get you more favorable loan terms. Compare lenders that offer co-signed and joint loans. Typically, a cosigner has a stronger financial history than the primary borrower. This can help someone get approved for a loan they might not qualify for on. Your co-signer should be in a good financial position, with relatively low levels of debt and an income that can handle the payments. When considering an. Example. You need a personal loan but a financial institution may require a co-signer to jointly sign with you in order to approve your loan, which. Adding a cosigner to your loan could help you get approved and may even qualify you for a better rate. Here's a list of lenders that accept cosigners. From consolidating debt to funding a major purchase, an unsecured personal loan from U.S. Bank might be just what you need. Apply online now! Best bad credit personal loans. OneMain Financial. · Est. APR. - %. Loan Amount. $1, to $20, ; Best for large personal loans. BHG Financial. You can cosign just about any type of loan, including student loans, auto loans, home improvement loans, personal loans, credit card agreements, and mortgage. If you're under 18 years old: We welcome you to apply for a Start Personal Loan, as long as you have a parent or other co-signer on your loan. Parents will have. Adding a co-signer to your loan application can get you more favorable loan terms. Compare lenders that offer co-signed and joint loans. Typically, a cosigner has a stronger financial history than the primary borrower. This can help someone get approved for a loan they might not qualify for on. Your co-signer should be in a good financial position, with relatively low levels of debt and an income that can handle the payments. When considering an. Example. You need a personal loan but a financial institution may require a co-signer to jointly sign with you in order to approve your loan, which. Adding a cosigner to your loan could help you get approved and may even qualify you for a better rate. Here's a list of lenders that accept cosigners. From consolidating debt to funding a major purchase, an unsecured personal loan from U.S. Bank might be just what you need. Apply online now! Best bad credit personal loans. OneMain Financial. · Est. APR. - %. Loan Amount. $1, to $20, ; Best for large personal loans. BHG Financial.

If you have bad credit, a personal loan with a cosigner may be a smart option. If you need it fast or the same day then we are here to help. Get Started. Some banks, credit unions, and online lenders allow applications to apply and secure a personal loan with a cosigner. If you have poor credit, having a. As a cosigner, you will be asked to complete all of the loan paperwork alongside the primary borrower. As part of the process, the lender will likely check. When considering a personal loan, a cosigner with a solid credit score can boost your loan amount and improve your interest rate. This can be especially helpful. Key Takeaways · If you have poor credit and wouldn't qualify for a personal loan on your own, having a co-signer with good credit can help you get approved. How to get a personal loan with a cosigner · Check your credit scores · Gather documents for you and your cosigner · Prequalify · Apply · Begin repayment. Better rates: · An opportunity to build credit: ; Credit rating impact: · May reduce ability to obtain future credit: ; Get a cosigner release · Monitor the student. How to apply for a personal loan with a cosigner · Fill out the application with your cosigner: You and your cosigner will need to fill out the application. A co-signer is someone who may add their name to your application to help you qualify for a loan, but they aren't financially obligated to pay back the loan. You can apply to release a co-signer after making 24 months of consecutive on-time, full payments for private student loans—only 12 months required for. However, it's also an opportunity to have a positive impact for a borrower in a tight financial spot. For example, co-signing a personal loan allows you to help. I want to get a personal loan, pay off my cards, and cancel them. Currently I don't make much - about $50k/year, but my husband makes $k after taxes. When you co-sign a loan, you promise to pay off the loan in the event the primary borrower is unable to pay off the loan. A co-signer becomes necessary when. Basically, a cosigner can help a borrower with no credit or bad credit get approved for a personal loan. When the cosigner adds their name and credit score to. When someone co-signs on a loan, from a credit standpoint, it is as though they had taken the loan out themselves. Co-signing a loan also could lower your available credit, making it more difficult for you to get a loan in the future, depending on your income. Consider, for. But getting a cosigner or guarantor — someone with good credit who promises to pay back your loan if you default — may help you access the funds you need. Some. That said, if you don't have great credit, or if your income is borderline when it comes to justifying the loan, having a creditworthy cosigner can increase. You can cosign just about any type of loan, including student loans, auto loans, home improvement loans, personal loans, credit card agreements, and mortgage. To qualify as a cosigner, you'll need to provide financial documentation with the same information needed when you apply for a loan. This may include: Income.

Nba Top Shot Auction

Rookie Auction is under way The auction winner will receive an Ultimate collectible from a NBA Top Shot. Place your bid. An auction of a Top Shot highlight from Victor Wembanyama's debut ended at $, Top Rumors, NBA Top Shot, Victor Wembanyama, San Antonio Spurs. shares. The 1 of 1 NFT will be minted and sent to your NBA Top Shot and Dapper collection if you win the auction. Auctions last for 7 days ( hours) unless a new. Although users had the ability to purchase multiple, packs would still sit on sale for days, until Dapper would eventually decide to take them. An auction of a Top Shot highlight from Victor Wembanyama's debut ended at $, Top Rumors, NBA Top Shot, Victor Wembanyama, San Antonio Spurs. shares. Explore NBA TopShot NFT marketplace data with trading volume, average price, top sales and traders count. Analyze trading trends on DappRadar. The first round of the Ultimate Rookie Pack auction, featuring Chet Holmgren's 1-of-1 Ultimate collectible, has concluded. Market tracker for NBA Top Shot. Top sales, prices, market cap, mints, attributes, traits, account valuation tool, scarcity & more. Buy NBA Top Shot NFTs. Track NBA Top Shot historical sales volume growth over time. Monthly and daily aggregated sales totals. Filter sales reports by attribute. Rookie Auction is under way The auction winner will receive an Ultimate collectible from a NBA Top Shot. Place your bid. An auction of a Top Shot highlight from Victor Wembanyama's debut ended at $, Top Rumors, NBA Top Shot, Victor Wembanyama, San Antonio Spurs. shares. The 1 of 1 NFT will be minted and sent to your NBA Top Shot and Dapper collection if you win the auction. Auctions last for 7 days ( hours) unless a new. Although users had the ability to purchase multiple, packs would still sit on sale for days, until Dapper would eventually decide to take them. An auction of a Top Shot highlight from Victor Wembanyama's debut ended at $, Top Rumors, NBA Top Shot, Victor Wembanyama, San Antonio Spurs. shares. Explore NBA TopShot NFT marketplace data with trading volume, average price, top sales and traders count. Analyze trading trends on DappRadar. The first round of the Ultimate Rookie Pack auction, featuring Chet Holmgren's 1-of-1 Ultimate collectible, has concluded. Market tracker for NBA Top Shot. Top sales, prices, market cap, mints, attributes, traits, account valuation tool, scarcity & more. Buy NBA Top Shot NFTs. Track NBA Top Shot historical sales volume growth over time. Monthly and daily aggregated sales totals. Filter sales reports by attribute.

Simply list your NBA TopShot NFTs using our website or our free mobile app. After the buyer receives your NFT and completes the transaction, the sale proceeds. likes, 5 comments - nbatopshot on March 17, "Rip City fans, it's your turn Portland's 1-of-1 NFT auction that unlocks VIP. auction house. # NBA Top In this analysis, I'm looking at if the “Play type” attribute of NBA Top Shot NFTs has any affect on its sales. NBA Top Shot is an NFT marketplace platform for owning plays made in basketball games. The NBA and NBA Top Shot have partnered up to create groundbreaking, 1-of-1 NFTs for each of the league's 30 teams. Minted for the ultimate Phoenix Suns fan. Moments burned. Layup - Dec 30 , Base Set (Series 2), LAC. Lowest Ask: USD $ Avg Sale. USD $ View Listing. Layup - Nov 17 , Game. On NBA Top Shot, Dapper Labs' video collectibles platform on the Flow blockchain, the largest on-chain sale for the NBA championship-winning Bucks star is. Latest NBA Top Shot News · The Leaderboard ends at 12pm ET · Early Access concludes at 2pm ET · Join The Drop at 3pm ET · The Moments are minted to 75 each · 9. Fast Break. Log In Start. Blog · Top Shot · Join Discord · Follow Us · Help Center · Get on Google Play Download on the App Store. NBA Top Shot. BETA. Log. The whole NFT digital collectible market has been exploding lately, but NBA Top Shot is in a league of its own. NBA Top Shot is a line of officially. Layup - Dec 23 , Base Set (Series 2), CHI. Lowest Ask: USD $ Avg Sale. USD $ View Listing. Handles - Jun 8 , WNBA (Summer ), DAL. It sounds like it's basically an auction-style matchmaker for off-market deals. At the end of the auction, the service provides the seller and. We're keeping track of the top biggest NBA Top Shot sales. NBA Top Shot is the official digital collectibles game for the National Basketball Association. A Top Shot Sale Collection contains a capability to the. Different pack editions can have varying numbers and types of moments inside. E.g.: the first Western Conference Finals packs go on sale at 12pm PT TODAY with. What is the most expensive NBA Top Shot Moment? Moments featuring LeBron James dominate the top 10 most expensive sales on NBA Top Shot with the highest sale. On NBA Top Shot, Dapper Labs' video collectibles platform on the Flow blockchain, the largest on-chain sale for the NBA championship-winning Bucks star is. NBA Top Shot is the official digital video collectible of the NBA and WNBA. On NBA Top Shot, you can collect and own the greatest basketball highlights of. Moments burned. Layup - Dec 30 , Base Set (Series 2), LAC. Lowest Ask: USD $ Avg Sale. USD $ View Listing. Layup - Nov 17 , Game. Top Shot is a blockchain-based platform that allows sports fans to buy, sell, and trade non-fungible tokens (NFTs) of NBA video highlights.

Callcredit Score

With Credit Close-Up SM, you have free and easy access to your monthly credit update which includes: FICO® Score 9 from Experian. Simple access via Wells Fargo. View, track, and learn how to improve your score with our free credit score program. Let's get started! A credit score of or above is generally considered good. A score of or above on the same range is considered to be excellent. Here is some valuable information about your credit score and your credit report, as well as tips to help you manage them and try to avoid credit fraud. About this app. arrow_forward. Our TransUnion Credit Monitoring App lets you check your credit report anytime, anywhere! Checking your Score does not hurt your. A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit. Experian is committed to helping you protect, understand, and improve your credit. Start with your free Experian credit report and FICO® score. A credit score is a number from to that rates a consumer's creditworthiness. The higher the score, the better a borrower looks to potential lenders. Check your credit score. Check your score anytime without impacting your credit. We update your score regularly and tell you what's changed. With Credit Close-Up SM, you have free and easy access to your monthly credit update which includes: FICO® Score 9 from Experian. Simple access via Wells Fargo. View, track, and learn how to improve your score with our free credit score program. Let's get started! A credit score of or above is generally considered good. A score of or above on the same range is considered to be excellent. Here is some valuable information about your credit score and your credit report, as well as tips to help you manage them and try to avoid credit fraud. About this app. arrow_forward. Our TransUnion Credit Monitoring App lets you check your credit report anytime, anywhere! Checking your Score does not hurt your. A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit. Experian is committed to helping you protect, understand, and improve your credit. Start with your free Experian credit report and FICO® score. A credit score is a number from to that rates a consumer's creditworthiness. The higher the score, the better a borrower looks to potential lenders. Check your credit score. Check your score anytime without impacting your credit. We update your score regularly and tell you what's changed.

Get on top of your Credit Scores and Reports & take action directly with your creditors through our patented online system. Start a free trial today! Your free credit score with NerdWallet unlocks credit monitoring. Check your free credit score and credit report, and get alerts about changes. So it's especially important that you understand your credit report, credit score, and the companies that compile that information, credit bureaus. This. Your credit score is an important number when it comes to your personal finances. As a member of UW Credit Union, you can monitor your credit score for free. See your free credit scores, reports and personalized tips and tools to help you achieve your financial goals. Start making progress today. A credit score predicts how likely you are to pay back a loan on time, based on information gathered on your credit reports. Get the complete picture with a free credit report from Experian. Includes your FICO Score for free and Experian Boost. $0 and no credit card is required. What are credit score ranges and what is a good credit score? · to Excellent Credit Score Individuals in this range are considered to be low-risk. Your credit score is a mathematical assessment of the likelihood you will repay what you borrow. It is based on the information in your credit report. How to access Credit Score Plus · Log in to online banking or the mobile app. · From the menu, navigate to Financial Health. · Select Credit Score Plus. 90% of top lenders use FICO Scores. Get credit scores, credit reports, credit monitoring & identity theft monitoring in one place. Whether you're applying. Know your rights · Requesting your credit reports will not hurt your credit score · Check for available protections that may apply to renters · You can also. A credit score is a number that represents a rating of how likely you are to repay a loan and make the payments on time. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit. Components of a Credit Score · 30% Amounts Owed: Debt with outstanding balances and payments still being made. · 35% Payment History: Also known as payment. Do you know what a credit score is? myFICO has the answers for why credit scores are important & what credit scores you should be looking at. An excellent credit score can help you receive the best APRs from lenders and give you a higher chance of being approved for credit cards and loans. American Express MyCredit Guide is a free service that allows you to view your FICO Score and Experian credit report for free. Background. On October 24, , FHFA announced the validation and approval of two new credit score models, FICO 10T and VantageScore , for use by the. Check your credit score and get free credit monitoring instantly. No credit card required and it won't hurt your credit score.

Best Banks For Medical Students

Banking solutions for medical students Scotiabank has worked with MD Financial Management (MD), to deliver the Scotiabank Healthcare+ Physician Banking. best financial aid options as you prepare for your life as a doctor. Best Private Student Loans for Medical School. Sallie Mae Student Loans. Fixed APR Medical or dental student? Find loan options, banking and special savings to help you get through school and beyond. Ranked top five for student banking. U.S. Bank received the Money Best Banks for Students award in August At Emory University School of Medicine, the average student graduates with $, in debt. Many top candidates are discouraged from attending medical school. Bank of America; Citizens Bank; Santander Bank; Sovereign Bank; Student Federal Credit Union; TD Bank; Wells Fargo. Banking Relationship Disclosures. Your medical school journey starts here. Bundle and save with us. Save on bank fees and enjoy great rates on your student line of credit, chequing account and. From USMLE and COMLEX through NBME shelf exams, BoardVitals offers medical students comprehensive preparation for national exams administered during medical. We generally see Canadian medical students hold a student line of credit with one of the big Canadian banks (Canada's “Big Five” include Royal Bank of. Banking solutions for medical students Scotiabank has worked with MD Financial Management (MD), to deliver the Scotiabank Healthcare+ Physician Banking. best financial aid options as you prepare for your life as a doctor. Best Private Student Loans for Medical School. Sallie Mae Student Loans. Fixed APR Medical or dental student? Find loan options, banking and special savings to help you get through school and beyond. Ranked top five for student banking. U.S. Bank received the Money Best Banks for Students award in August At Emory University School of Medicine, the average student graduates with $, in debt. Many top candidates are discouraged from attending medical school. Bank of America; Citizens Bank; Santander Bank; Sovereign Bank; Student Federal Credit Union; TD Bank; Wells Fargo. Banking Relationship Disclosures. Your medical school journey starts here. Bundle and save with us. Save on bank fees and enjoy great rates on your student line of credit, chequing account and. From USMLE and COMLEX through NBME shelf exams, BoardVitals offers medical students comprehensive preparation for national exams administered during medical. We generally see Canadian medical students hold a student line of credit with one of the big Canadian banks (Canada's “Big Five” include Royal Bank of.

Why you can trust Forbes Advisor's ratings · Featured Partner · Top student current accounts · Santander · Nationwide · NatWest Student Bank Account · Royal Bank of. Best Medical Practice Loans for Dentists, Doctors, Optometrists, and Vets · Huntington Bank.: Best one-stop shop · SunTrust.: Best for medical students · TD. banks, groups, and regions than just healthcare IB in London. I graduated with an MBBS in Medicine and BSc in Management (intercalated) from a top london. Education Loan for Medical Students - Know all the Top Banks that offers education loan for Medical Students in India. Check Eligibility & Documents. Discover our specialized banking solutions for medical and dental students who are in school or in residency. Find the best banking product for your needs. best on exam day. Clinical ECG Qbank. Solidify your ECG To boost your confidence during your medical exam prep, all medical student question banks. What BMO bank accounts are best for medical students currently in residency? For medical students currently in residency, we recommend a Premium Plan. Uworld is the gold standard for USMLE preparation and all medical student sees it as the number one, but many medical students uses more than. Ascent provides medical school student loans to help you pay for graduate school. Check out our medical student loan options and benefits to help you. Financial help for doctors and their families · Help for medical students There are two things you should consider when deciding which is best: How much. Scotiabank's Healthcare+ Physician Banking Program for medical residents offers exclusive fee waivers and rewards on your chequing account, select credit. Many lenders — including Ascent, College Ave and Sallie Mae — offer private medical school loans with specific benefits for aspiring health professionals, like. Becoming a doctor or physician-scientist, is a good career choice, both socially and financially. Although medical school may be expensive, there are options. Students are able to enroll their US bank accounts in direct deposit so that all student loan and account refunds will be deposited directly into the enrolled. PassMedicine, Quesmed and BMJ OnExamination emerge as top contenders, with different strengths and weaknesses between them. PassMedicine has a. 1. Pass Medicine: This is a UK based question bank and library which contains well over a free questions available to Medical students. The Medical School Loan vs the Federal Direct Grad PLUS Loan. After you explore federal loans, you may find the Sallie Mae Medical School loan to be a good. Most medical students need loans to pay for medical school. Public and private loans are available to help cover the costs, but there are many differences. The best free medical exam Question Banks ; USMLE Step 1. Challenging board-style questions in high yield topics. ; MSRA. s free Multi-Specialty Recruitment. Are you a student or grad in the medical, dental or vet space? We offer a range of financial and banking solutions just for you. Find out how we can support.

How To Look For Health Insurance

Our medical insurance plans are designed to meet the needs of New Yorkers like you. Find the health coverage you deserve at a reasonable price. Find out how much you can save on health insurance plans. You can browse plans and estimated prices here any time. Next, you can log in to apply, see final prices, pick a plan, and enroll. Purchase a policy through Covered California: California's Health Insurance Marketplace. As part of the Affordable Care Act, California created a healthcare. Florida Blue offers affordable health insurance plans to individuals, families, and businesses. Explore our medical, dental, and Medicare health care plans. Need help finding a health insurance plan? Try our plan finder to see the plan options available to you and explore different coverage options. How much will it cost? It is important to look at your total out-of-pocket costs including premiums, deductibles, co-pays and coinsurance. · Can I see my doctor? Shop our Medicaid, Essential Plans, and Marketplace Plans. Find Your Plan. For Long-Term Care. Our plans offer hospital, medical, and prescription. Enter a health insurance company name and the tool will tell you which providers are in the health insurance company's network. Search by Health Insurance. Our medical insurance plans are designed to meet the needs of New Yorkers like you. Find the health coverage you deserve at a reasonable price. Find out how much you can save on health insurance plans. You can browse plans and estimated prices here any time. Next, you can log in to apply, see final prices, pick a plan, and enroll. Purchase a policy through Covered California: California's Health Insurance Marketplace. As part of the Affordable Care Act, California created a healthcare. Florida Blue offers affordable health insurance plans to individuals, families, and businesses. Explore our medical, dental, and Medicare health care plans. Need help finding a health insurance plan? Try our plan finder to see the plan options available to you and explore different coverage options. How much will it cost? It is important to look at your total out-of-pocket costs including premiums, deductibles, co-pays and coinsurance. · Can I see my doctor? Shop our Medicaid, Essential Plans, and Marketplace Plans. Find Your Plan. For Long-Term Care. Our plans offer hospital, medical, and prescription. Enter a health insurance company name and the tool will tell you which providers are in the health insurance company's network. Search by Health Insurance.

Get helpful guidance to understand your health plan or find quality coverage for you and your family. Health benefits and health insurance plans contain. The Affordable Care Act (ACA) gives more people access to health insurance. Use the ACA's Health Insurance Marketplace to find more affordable health insurance. Consider your health care needs. · Which plan type is best? · Check for pharmacy benefits. · Ask your healthcare providers what insurance plans they accept. Our plans are made to deliver what matters, from quality coverage to caring support. Find a plan option that works for you. To get started, go to cryptoforu.site to find your state Health Insurance Marketplace. Each state's Marketplace has its own enrollment instructions. Find the health insurance plan in California that fits your needs and budget at Anthem. Explore a variety of plan options for individual and family. Make a note of what medical services you and your family routinely use. Then, when you are comparing plans, find and read the Summary of Benefits and Coverage . health insurance coverage options in that State.” The cryptoforu.site website There are many possibilities for innovative uses of this data, and we look. cryptoforu.site is the one stop shop for Mainers looking for health coverage. There you will find information about purchasing major medical insurance. Get helpful guidance to understand your health plan or find quality coverage for you and your family. Health benefits and health insurance plans contain. The Marketplace gives you an easy way to compare health insurance plans so you can choose the one that's right for your health needs and your budget. Medicare ·, ; Medicaid ·, the ; Children's Health Insurance Program (CHIP) ·, or another source that provides ; qualifying health coverage ·, you can find coverage. The Affordable Care Act (ACA) gives more people access to health insurance. Use the ACA's Health Insurance Marketplace to find more affordable health insurance. FEHB Plan Information for Choosing a state below will take you to a list of all plans available in that state, as well as links to the plan brochures. Do you need health insurance? · Get Covered. Find the right health coverage for you and your family. Most Minnesotans qualify for financial help. · Stay Covered. Your total spending on health care, not just the · Enrolling in a Silver plan if you qualify for extra savings. · The premium tax credit. You'll also find out if. NY State of Health Essential Plan: this is a free or low-cost insurance plan for adults with low incomes who don't qualify for Medicaid. · Qualified Health Plans. Check the plan's provider network to make sure there are doctors and hospitals near you who take that plan. If you go out of the network to receive care, you. Need help finding a health insurance plan? Try our plan finder to see the plan options available to you and explore different coverage options. Your total spending on health care, not just the · Enrolling in a Silver plan if you qualify for extra savings. · The premium tax credit. You'll also find out if.