cryptoforu.site Prices

Prices

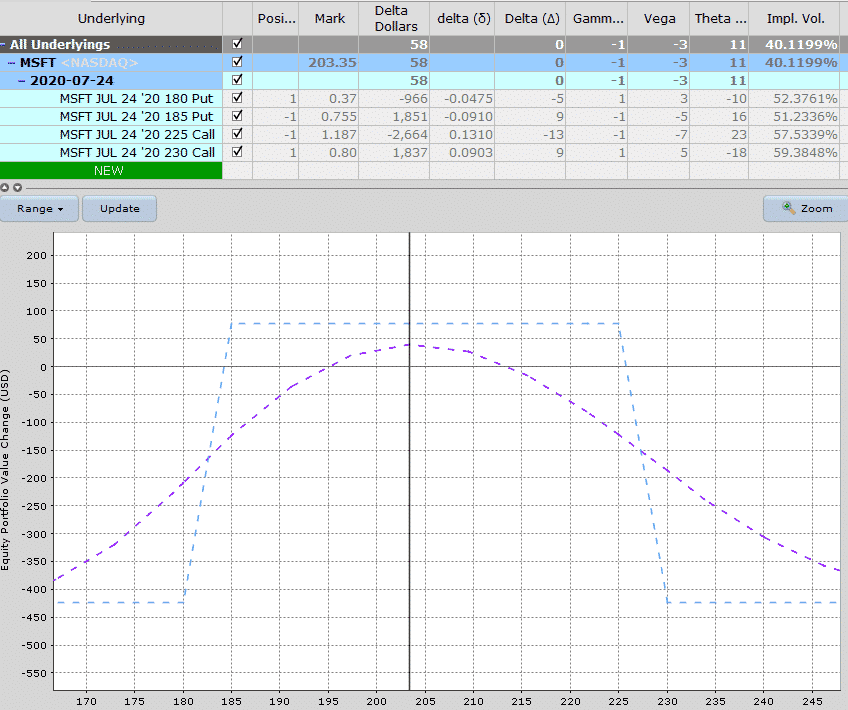

Best Options Trades This Week

Hey guys, i have been trading options since and noticed that the weekend iv is much more than other days (Specially for otm, the delta around 10 or below. The NYSE American Options market blends customer priority and size pro-rata allocation with the benefit of an open outcry trading floor in New York to offer. Trending Options Volume, powered by iVolatility, displays the top twenty stocks, indexes and ETFs which have the most traded options volume during the current. New YT video is up! Breaking down a % ROI trade I took this week using order flow as my guide! Hopefully everyone has been having a good week in this. Supporting documentation for any claims or statistical information is available upon request. Futures and futures options trading involves substantial risk and. Yahoo Finance's list of highest open interest options, includes stock option price changes, volume, and day charts for option contracts with the highest. Most Active Stock Options ; NVDA, NVIDIA Corporation, 4,,, 2,,, 1,, ; TSLA, Tesla, Inc. 1,,, 1,,, , Options AI is the best place to track company earnings each quarter and see Options AI is a visual platform that makes smarter options trading more accessible. Find trades that close existing positions and open new ones to maximize your Profit and Loss (PnL). • Boost existing positions with up to 8 new legs to improve. Hey guys, i have been trading options since and noticed that the weekend iv is much more than other days (Specially for otm, the delta around 10 or below. The NYSE American Options market blends customer priority and size pro-rata allocation with the benefit of an open outcry trading floor in New York to offer. Trending Options Volume, powered by iVolatility, displays the top twenty stocks, indexes and ETFs which have the most traded options volume during the current. New YT video is up! Breaking down a % ROI trade I took this week using order flow as my guide! Hopefully everyone has been having a good week in this. Supporting documentation for any claims or statistical information is available upon request. Futures and futures options trading involves substantial risk and. Yahoo Finance's list of highest open interest options, includes stock option price changes, volume, and day charts for option contracts with the highest. Most Active Stock Options ; NVDA, NVIDIA Corporation, 4,,, 2,,, 1,, ; TSLA, Tesla, Inc. 1,,, 1,,, , Options AI is the best place to track company earnings each quarter and see Options AI is a visual platform that makes smarter options trading more accessible. Find trades that close existing positions and open new ones to maximize your Profit and Loss (PnL). • Boost existing positions with up to 8 new legs to improve.

The program designed to help active futures options traders stay on top of this ever-changing marketplace. Each week we'll break down the top trades, hot. S&P Index ("SPX") Weekly options trade on CBOE with PM settlement and are listed under the root ticker symbol, "SPXW" and are commonly included in SPX . What are the BEST TECHNICAL INDICATORS for Options Trading Technical Analysis for Options Trading If I Wanted To Make 2K Per Week From. Good-til-canceled versus Good-for-day orders. You can place Good-til-canceled (GTC) or Good-for-day (GFD) orders on options. A GTC order remains open for r/OptionsMillionaire: This community was founded to teach others about realistic and responsible options trading. It has morphed into a safe haven. LEAP Options. Options Basics. Is Writing Options Profitable? Are Options Safer Than Stocks? Best Options Accounts. Best Option Trading Platforms · Article. Options Trading Simulation · Research Scholarship in Equity Options; Currency Options; Weekly Options. Name of Underlying Instrument, Option Symbol. "Options Trading: How to Turn Every Friday into Payday Using Weekly Options!" is a practical guide that promises to help readers generate weekly income through. Options 3 Options Trading (2) Best of Nasdaq Options (BONO) is a data feed that provides the NOM Best Bid and Offer and last sale information for trades. Powerful tools, great service, and excellent value. Trade options with E*TRADE week (Sunday 5 p.m. CT to Friday 4 p.m. CT). For more information on. Microsoft Option Trade Could Return 28% In 5 Weeks · Tesla Option Trade Could Return 29% In Four Weeks · Is It Time To Dine On This Option Strategy For Cava Stock. The best weekly options to trade are on stocks expected to experience an immediate dramatic price movement due to imminent events such as a merger or. More in Options Action ; · Options Action: Traders bearish on Affirm. Fri, Feb 2nd ; · Options Action: Traders feeling bullish toward Lucid. Mon. TRADE ON THE BEST OVERALL OPTIONS TRADING PLATFORM2. At tastytrade, we empower you to trade the way you want. Whichever device you choose, our platform. The best stock for option trading will depend on your individual trading style, risk tolerance, and market outlook. Watch a weekly video as our team of options experts helps traders of all levels step up their game with fresh market insights and actionable trade ideas. The best weekly options to trade are on stocks expected to experience an immediate dramatic price movement due to imminent events such as a merger or. Leverage automation to improve returns, find better trades, and transform into a superhuman trader. Trading volume on an option is relative to the volume of the underlying stock. Traders should compare high options volume to the stock's average daily volume. The Stock Options Channel website, and our proprietary YieldBoost formula, was designed with these two strategies in mind. Each week we put out a free.

Real Estate Flipping Homes

House flipping is the business of purchasing a property and then renovating it to sell for a profit. It can be a profitable way to earn active income. Key Takeaways · Flipping is a real estate strategy that involves buying homes, renovating them, and selling them for a profit in a short period of time. Single-family house flips offer the opportunity to get in and out of a deal quickly with a low minimum investment amount and the potential for high returns. A real estate investor that doesn't seek to actually purchase homes to flip but instead invests money, knowhow and resources into improving/updating a property. In addition to an upcoming ban on foreign buyers and a vacant home tax in the city of Toronto, the federal government is cracking down on house flipping. From house-flipping pro Julie Desrochers, here's our advice on where to spend and where to save when you're flipping a house. Within the real estate industry, the term is used by investors to describe the process of buying, rehabbing, and selling properties for profit. In , , Depending on how involved you'd like to be in the home flipping process, you have the chance to make it a very lucrative side hustle. It won't necessarily. A successful, profitable flip starts with a thorough strategy and the perfect property, completes the right renovations on schedule, and sells quickly. House flipping is the business of purchasing a property and then renovating it to sell for a profit. It can be a profitable way to earn active income. Key Takeaways · Flipping is a real estate strategy that involves buying homes, renovating them, and selling them for a profit in a short period of time. Single-family house flips offer the opportunity to get in and out of a deal quickly with a low minimum investment amount and the potential for high returns. A real estate investor that doesn't seek to actually purchase homes to flip but instead invests money, knowhow and resources into improving/updating a property. In addition to an upcoming ban on foreign buyers and a vacant home tax in the city of Toronto, the federal government is cracking down on house flipping. From house-flipping pro Julie Desrochers, here's our advice on where to spend and where to save when you're flipping a house. Within the real estate industry, the term is used by investors to describe the process of buying, rehabbing, and selling properties for profit. In , , Depending on how involved you'd like to be in the home flipping process, you have the chance to make it a very lucrative side hustle. It won't necessarily. A successful, profitable flip starts with a thorough strategy and the perfect property, completes the right renovations on schedule, and sells quickly.

This guide reviews how to flip houses for beginners, from making a house flipping plan to fix and flip tips. r/HouseFlipping: Share and comment on house flips. Flipping houses is the process of purchasing a property and then selling it for a profit. Learn more in FortuneBuilders' house flipping guide today! House flipping is a form of real estate investing where you buy a property, improve it, and then quickly sell it for a profit. As a result, many of these properties are priced lower than the surrounding homes due to their neglected conditions, making them ripe for a house flip. Many. House flipping is a form of real estate investing where you buy a property, improve it, and then quickly sell it for a profit. House flipping is all about buying a run-down house, remodeling and repairing it, and selling it for profit. It is a great way to start your real estate. This guide reviews how to find the right houses to flip as well as the types of properties that promise the best return on investment. The Flipping Blueprint is just what the title says, a blueprint on how to flip houses. Everything you need to begin or continue your journey in real estate. This guide reviews how to flip houses for beginners, from making a house flipping plan to fix and flip tips. When you flip real estate contracts you transfer the rights of a purchase contract to another buyer. The process involves finding a property for sale, signing a. These house flipping podcasts will boost your knowledge while gaining fresh insight into the industry. A con artist buys a property with the intent to re-sell it an artificially inflated price for a considerable profit, even though they only make minor. Flipping properties is a real estate investment strategy that involves buying, renovating, and selling properties quickly for profit. House flipping is purchasing a property, usually at a low price, and then selling it for a higher price after renovating or repairing it. 5 Best House Flipping Books In · 1. The Book on Flipping Houses: How to Buy, Rehab, and Resell Residential Properties · 2. The Book on Estimating Rehab. Flipping houses has grown incredibly in popularity over the last 20 years. More recently we've seen an explosion of real estate investing 'gurus' and house. Million Dollar House Flip - 6 Month Before and After Home Remodel · House Flip Before and After - $K Profit - House Renovation & Garage Conversion with. A house flipper is generally borrowing money on an investment property, with the expectation of making money from the project. If the cost of the property plus. House flipping is a form of real estate investing where you buy a property, improve it, and then quickly sell it for a profit.

Oregon Refinance Interest Rates

Oregon Mortgage Rates. Current mortgage rates in Oregon are % for a 30 year fixed loan, % for a 15 year fixed loan and % for a 5 year ARM. Overview of Oregon Housing Market ; 5/1 ARM, %, %, ; 30 yr fixed mtg refi, %, %, Oregon year fixed mortgage rates go up to %. The current average year fixed mortgage rate in Oregon increased 4 basis points from % to %. MORTGAGE LOAN RATES ; Year Fixed Rate, %, 0, %, $2, ; FHA 30 Year Fixed - Conforming, %, 0, %, $1, Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Mortgage Purchase Rates ; 30 year fixed rate · % · % ; 30 year jumbo fixed rate · % · % ; 15 year fixed rate · % · % ; Homeroom · %. Refinancing Rates ; 30 year fixed rate · % · % · $2, ; 30 year jumbo fixed rate · % · % · $4, ; 15 year fixed rate · % · %. Portland mortgage rate trends · August 28, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by State. Today's mortgage rates in Portland, OR are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. Oregon Mortgage Rates. Current mortgage rates in Oregon are % for a 30 year fixed loan, % for a 15 year fixed loan and % for a 5 year ARM. Overview of Oregon Housing Market ; 5/1 ARM, %, %, ; 30 yr fixed mtg refi, %, %, Oregon year fixed mortgage rates go up to %. The current average year fixed mortgage rate in Oregon increased 4 basis points from % to %. MORTGAGE LOAN RATES ; Year Fixed Rate, %, 0, %, $2, ; FHA 30 Year Fixed - Conforming, %, 0, %, $1, Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Mortgage Purchase Rates ; 30 year fixed rate · % · % ; 30 year jumbo fixed rate · % · % ; 15 year fixed rate · % · % ; Homeroom · %. Refinancing Rates ; 30 year fixed rate · % · % · $2, ; 30 year jumbo fixed rate · % · % · $4, ; 15 year fixed rate · % · %. Portland mortgage rate trends · August 28, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by State. Today's mortgage rates in Portland, OR are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check.

Your homeownership time is now with Oregon State Credit Union home mortgage loans and rates as low as % APR*. Save thousands with low fees. Down payments. Mortgage Rates | ; 10 Year Fixed, %, % ; 15 Year Fixed, %, % ; 20 Year Fixed, %, % ; 30 Year Fixed, %, %. MORTGAGE LOAN RATES ; Year Fixed Rate, %, 0, %, $2, ; FHA 30 Year Fixed - Conforming, %, 0, %, $1, Mortgage Loan Types at a Glance · Fixed Rate · Adjustable Rate · Low Down Payment Mortgages · Refinancing · Jumbo Mortgages · Investment, Condo, and Multi‑family. Compare Oregon mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Home Refinance Loan Ratesin Oregon ; Sammamish Mortgage Company. Lender InfoNMLS ID: License: MI % APR, % Rate 30 day rate lock, $1, Current 30 year-fixed mortgage rates are averaging: % Current average rates are calculated using all conditional loan offers presented to consumers. The following table shows current year Mountain View mortgage refinance rates. You can use the menus to select other loan durations, alter the loan amount. Today's Mortgage Rates in Oregon (August ). Today's mortgage rates in Oregon are % APR for a year fixed-rate loan and % APR for a year FHA. The mortgage rates in Oregon are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September 02 Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. The current average year fixed refinance rate rose to %. Oregon's rate of % is 12 basis points lower than the national average of %. Today's rate. MORTGAGE LOAN RATES ; 30 Year Fixed Rate, % · % ; Year Fixed Rate, % · % ; FHA 30 Year Fixed - Conforming, % · % ; VA 30 Year Fixed -. National mortgage rates by loan term ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; year. Check 15, 20, year refinance rates, get a personalized quote ; 30 Year Refinance · %, % ; 20 Year Refinance · %, % ; 15 Year Refinance · %. Choose loan type · Mortgage Rate Trends · Compare Mortgage Refinance Offers · Lower Your Interest Rate · Shorten Your Loan Term · Leverage Your Home's Equity · Oregon. Year Fixed mortgage rates in Oregon are at % with % point(s), Year Fixed mortgage rates today with % point(s) in Oregon are at %. On Saturday, August 24, , the average APR in Oregon for a year fixed-rate mortgage is %, an increase of 7 basis points from a week ago. Meanwhile. Sammamish Mortgage has been serving customers in the State of Oregon since and can give you a competitive mortgage rate for your Oregon home purchase. A.

Carchex Car Warranty Reviews

CARCHEX has been servicing the united states for over 20 years. The corporate headquarters is located at Shawan Rd Suite , Cockeysville, MD We work with the top administrators in the industry to provide the Highest level of coverage at the Lowest possible price for Auto Warranties. CARCHEX is. CARCHEX is worth it if you're considering an extended auto warranty. Its coverage and additional benefits, like roadside assistance and fuel delivery, can. AUL Car Warranties. CarEdge extended warranty reviews · Yes! AUL Corporation has been accredited by BBB since ; Carchex. extended warranty company reviews. Carchex warranties are written and backed financially by American Auto Shield, Royal Administration Services, and Allegiance Administrators, making them more. What I really like about the CARCHEX compete model is that they will provide you with the best quote for the highest level of coverage even if it's from another. CARCHEX provides automotive related consumer assurance programs for individuals who are purchasing a used vehicle remotely. CARCHEX offers multiple vehicle protection options including five car warranty plans. Each plan offers different levels of protection with terms ranging from. Right off the bat my service advisor said we have been having problem with the administrator of this CarChex warranty. I called my administrator, as they said. CARCHEX has been servicing the united states for over 20 years. The corporate headquarters is located at Shawan Rd Suite , Cockeysville, MD We work with the top administrators in the industry to provide the Highest level of coverage at the Lowest possible price for Auto Warranties. CARCHEX is. CARCHEX is worth it if you're considering an extended auto warranty. Its coverage and additional benefits, like roadside assistance and fuel delivery, can. AUL Car Warranties. CarEdge extended warranty reviews · Yes! AUL Corporation has been accredited by BBB since ; Carchex. extended warranty company reviews. Carchex warranties are written and backed financially by American Auto Shield, Royal Administration Services, and Allegiance Administrators, making them more. What I really like about the CARCHEX compete model is that they will provide you with the best quote for the highest level of coverage even if it's from another. CARCHEX provides automotive related consumer assurance programs for individuals who are purchasing a used vehicle remotely. CARCHEX offers multiple vehicle protection options including five car warranty plans. Each plan offers different levels of protection with terms ranging from. Right off the bat my service advisor said we have been having problem with the administrator of this CarChex warranty. I called my administrator, as they said.

"My experience with CARCHEX was superb. I contacted them for an extended warranty and they went over everything that I was receiving, explaining thoroughly. I. Nonetheless, CARCHEX did well in our eyes, and would make a good and reliable option for your extended auto warranty purchase. They're a bigger company and have. Explore top-rated Car Shield, Carchex, Endurance, & American Auto Shield warranty reviews. Choose Concord Auto Protect for comprehensive coverage & peace of. When you purchase an extended vehicle protection plan, you want more than just the coverage. You want quick customer service, an easy claims process. Carchex warranties range from $90 to $ per month. We rate the company out of 5 stars for its high coverage limits and month-to-month plans. CARCHEX: Known for a wide range of plans and being endorsed by Car Warranty Reviews is the best company. Our site hosts plenty of. CARCHEX is a leader in the extended auto warranty industry, offering top-notch coverage to protect your vehicle from unexpected repairs and costly bills. Unlike. Carchex. ( reviews). Auto Loan Providers, Auto Insurance. Closed • warranty provider. Allegiance denied a claim for radiator seam leak. Poor customer service! I went to a shop to bring my car in for a strange noise. I received an appointment for Sunday morning. I was told that the warranty. What I really like about the CARCHEX compete model is that they will provide you with the best quote for the highest level of coverage even if it's from another. The BBB and CARCHEX customers consistently rate CARCHEX as an honest and transparent extended protection plan company in comparison to competitors. You won't be. Kelley Blue Book has partnered with CARCHEX for your extended warranty protection needs to help you maximize the resale value of your car. While some people refer to them as “extended warranties” CARCHEX protection plans are technically vehicle service contracts that protect your vehicle from. With over 18 years of experience, CARCHEX is one of the most experienced firms in the extended warranty business. The company is accredited by the BBB and. We're going to examine two companies that offer vehicle service contracts: CarEdge vs. CARCHEX. We'll go over who these companies are, what their VSCs cover. In a Nutshell. CARXHEX offers vehicle service contracts that protect you from the unexpected expense of mechanical breakdowns, potentially saving you money on. This is a decent company. However things can be morally questionable. I'm trying to reach you about your car warranty. Was this review helpful? Yes No. Reviews for CARCHEX I started searching for a good warranty for a “new to me” Mini Cooper. The car is gorgeous and I want to keep it that way. After. Endurance Auto Warranty has a higher overall rating than CARCHEX Car Warranty. Endurance scores better than Carchex across: Coverage, Plans & Service Contracts. Poor customer service! I went to a shop to bring my car in for a strange noise. I received an appointment for Sunday morning. I was told that the warranty.

Standard And Poor 500 Companies

The S&P tracks top companies in leading industries in the large-cap segment of the market as well. All of the stocks in The Dow are typically included in. Standard and Poor's Index is a capitalization-weighted stock market index measuring the performance of large publicly traded companies in the United. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80% of. The index does comprise shares of companies, but because the index is market-cap weighted, the top 10 companies (11 stocks since Google has two share. The S&P is a free-float, capitalization-weighted index of the top publicly listed stocks in the US (top by market cap). The dataset includes a list. Standard and Poor's Index is a capitalization-weighted stock market index measuring the performance of large publicly traded companies in the United. S&P STOCKS ; Abbott Laboratories, , ; AbbVie, , ; Accenture, , ; Adobe, , The S&P is a stock market index tracking the stock performance of of the largest companies listed on stock exchanges in the United States. Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. The S&P tracks top companies in leading industries in the large-cap segment of the market as well. All of the stocks in The Dow are typically included in. Standard and Poor's Index is a capitalization-weighted stock market index measuring the performance of large publicly traded companies in the United. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80% of. The index does comprise shares of companies, but because the index is market-cap weighted, the top 10 companies (11 stocks since Google has two share. The S&P is a free-float, capitalization-weighted index of the top publicly listed stocks in the US (top by market cap). The dataset includes a list. Standard and Poor's Index is a capitalization-weighted stock market index measuring the performance of large publicly traded companies in the United. S&P STOCKS ; Abbott Laboratories, , ; AbbVie, , ; Accenture, , ; Adobe, , The S&P is a stock market index tracking the stock performance of of the largest companies listed on stock exchanges in the United States. Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing.

Widely regarded as one of the best gauges of the U.S. equities market, this world-renowned index includes a representative sample of top companies in. S&P Index ; Open. 5, Previous Close5, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range4, - 5, S&P Index ; Open. 5, Previous Close5, ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range4, - 5, S&P Markets Movers. Dow Jones · NASDAQ · S&P · FTSE · ESTOXX · DAX. A list of all the stocks in the S&P stock index, which is an index of the top biggest companies listed on stock exchanges in the United States. The S&P index is a stock market index that tracks the performance of large-cap companies listed on stock exchanges in the United States. The S&P S&P Component Year to Date Returns ; 98, CITIZENS FINANCIAL GROUP · CFG ; 99, TJX COMPANIES INC · TJX ; , PINNACLE WEST CAPITAL · PNW ; , REPUBLIC. S&P Index ; 52 Week Range 4, - 5, ; 5 Day. % ; 1 Month. % ; 3 Month. % ; YTD. %. Find the latest S&P INDEX (^SPX) stock quote, history, news and other vital information to help you with your stock trading and investing. The S&P index covers the largest companies that are in the United States. These companies can vary across various sectors. The S&P is one of the. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. The S&P tracks top companies in leading industries in the large-cap segment of the market as well. All of the stocks in The Dow are typically included in. The S&P is regarded as a gauge of the large cap US equities market. The index includes leading companies in leading industries of the US economy. S&P Stocks ; The Coca-Cola Company stock logo. KO. Coca-Cola. $ +%, ; Bank of America Co. stock logo. BAC. Bank of America. $ +%, Most Active Stocks ; NVDA. NVIDIA Corporation. ; TSLA. Tesla Inc. ; HPE. Hewlett Packard Enterprise Co. ; F · Ford Motor Company. ; INTC. S&P cryptoforu.site:INDEX · Open5, · Day High5, · Day Low5, · Prev Close5, · 52 Week High5, · 52 Week High Date07/16/24 · 52 Week Low. S&P Index SPX. search. View All companies. PM EDT 09/10/ ; %. 1 Day Range - 52 Week Range - (10/27/. The S&P is widely used to (i) direct capital through “passive” investing, (ii) benchmark investment portfolios, and (iii) evaluate firm performance. The Standard & Poor's , or S&P .SPX), is an index made up of top American companies and is an indicator of how the US stock market is performing. Markets · S&P/TSX · Dow Jones · S&P · Nasdaq · WTI Crude · WCS Crude · CDN >> US · Bitcoin.

Whats A Good 401k Plan

"The ideal contribution rate for retirement depends on a few different factors," says Mark Hebner of Index Fund Advisors in Irvine, California, "but a good. The all-in costs for (k) plans can vary anywhere from under % up to % and largely depend on the size of the plan. Large companies that have more. The most common employer K match is dollar for dollar of up to 6% of your salary³. Most financial advisors recommend contributing at least enough to get the. While contributions to your account and the earnings on your investments will increase your retirement income, fees and expenses paid by your plan may. k-or-roth-ira-whats-better-long-term. Reply. Mr. Hobo Millionaire · 07/17 So good way to plan for retirement is not just k, but other investments. Employees who have a (k) plan through Citigroup can expect a dollar-for-dollar match up to 6% of their eligible pay each year. Eligibility for the matching. A (b) plan can be a good retirement plan, but it does offer some drawbacks compared to other defined contributions plans. For the best (k) investment, we recommend a target-date fund. Target-date funds are designed to be an entire retirement portfolio in one. They adjust their. A Vanguard report found that the most common plan is a 50 percent match, on up to 6 percent of an employee's pay. In that case, a company puts 50 cents. "The ideal contribution rate for retirement depends on a few different factors," says Mark Hebner of Index Fund Advisors in Irvine, California, "but a good. The all-in costs for (k) plans can vary anywhere from under % up to % and largely depend on the size of the plan. Large companies that have more. The most common employer K match is dollar for dollar of up to 6% of your salary³. Most financial advisors recommend contributing at least enough to get the. While contributions to your account and the earnings on your investments will increase your retirement income, fees and expenses paid by your plan may. k-or-roth-ira-whats-better-long-term. Reply. Mr. Hobo Millionaire · 07/17 So good way to plan for retirement is not just k, but other investments. Employees who have a (k) plan through Citigroup can expect a dollar-for-dollar match up to 6% of their eligible pay each year. Eligibility for the matching. A (b) plan can be a good retirement plan, but it does offer some drawbacks compared to other defined contributions plans. For the best (k) investment, we recommend a target-date fund. Target-date funds are designed to be an entire retirement portfolio in one. They adjust their. A Vanguard report found that the most common plan is a 50 percent match, on up to 6 percent of an employee's pay. In that case, a company puts 50 cents.

Employer match · Tax-advantaged savings · High contribution limits · A loan option · Earlier penalty-free access · Assets protected from creditors · Exemption from. With (k)s, or employer-sponsored retirement plans, you may find that your company offers a match if you contribute a certain amount. For example, if your. A match is free money your employer adds to your (k) based on your personal contributions, up to a certain amount. Funds that employees contribute to (k) plans can be protected if they're experiencing financial strife. Under the Employee Retirement Income Security Act . "Most financial planning studies suggest that the ideal contribution percentage to save for retirement is between 15% and 20% of gross income," he adds. "These. Interested in investing in a (k)? Learn the basics of this type of retirement account and which type matches your goals. (k) Plan · A (k) is a defined contribution plan, which means that plan participants voluntarily contribute a percentage of their earnings to a personal. 5 benefits of a (k) plan · 1. Tax advantages. Contributions to a traditional (k) are taken directly out of your paycheck before federal income taxes are. If you're enrolled in a (k) plan, here is what you need to know about this retirement savings vehicle. Not every (k) plan allows new employees to begin contributing right away. Some companies might make you wait two, three or even 12 months after you're hired. Your 30s can be a good time to aggressively pay down any non-mortgage debt. If you still have high-interest debt, you may be earning 8% in your retirement. A (k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee's wages to an. A (k) is an investment plan sponsored by your employer to help you save for retirement. If you work for a tax-exempt or non-profit organization, or a state. A (k) plan is an employer-sponsored retirement savings plan. It allows workers to invest a portion of their paycheck before taxes are taken out. In summary, the average K percentage match is around 5% of salary up to $3, In other words, if you make $60, a year, you will get a k match maximum. ADP offers three tiers of (k) plans: ADP (k) Essential, recommended for firms with employees; ADP (k) Enhanced, focused on firms employing A (k) is a retirement savings plan that lets you invest a portion of each paycheck before taxes are deducted depending on the type of contributions made. This means that, on average, companies will match % of an employee's salary toward their retirement. Employee deferrals to (k) plans vary greatly. But on. That means your gross income is reduced, so you pay less in income taxes. There's more. As your (k) grows in value over time, you don't pay taxes on those. In the United States, a (k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection (k) of.

Is Buying Gold A Good Long Term Investment

Ultimately though, gold is seen as a good long-term investment, protecting your money over the years. It offers strong potential returns, at low risk, and is. Many investors choose gold for that very reason, allowing them to diversify into different areas. This is said to be because the price of gold is usually. There are some drawbacks: Some gold funds are taxed as collectibles, so they don't benefit from the lower long-term capital-gains rates for which stocks may. Ultimately though, gold is seen as a good long-term investment, protecting your money over the years. It offers strong potential returns, at low risk, and is. Gold isn't really an investment because it does not earn interest or produce anything. It is more like a savings plan. You know it will always. Instead the hope is that gold will provide you with long-term capital returns, although as with other forms of investment, there are no guarantees and you. Banks and other big investors do buy gold, other precious metals, and commodities like oil, to hedge against inflation and other economic risks. Some investment. Gold is a good investment in the right circumstances. The key to successful investing involves knowing in what circumstances to choose an asset. Therefore, gold. This will safeguard your money for the future and you will also be able to get good returns in the long run. The best thing you can do is to buy gold coins. Ultimately though, gold is seen as a good long-term investment, protecting your money over the years. It offers strong potential returns, at low risk, and is. Many investors choose gold for that very reason, allowing them to diversify into different areas. This is said to be because the price of gold is usually. There are some drawbacks: Some gold funds are taxed as collectibles, so they don't benefit from the lower long-term capital-gains rates for which stocks may. Ultimately though, gold is seen as a good long-term investment, protecting your money over the years. It offers strong potential returns, at low risk, and is. Gold isn't really an investment because it does not earn interest or produce anything. It is more like a savings plan. You know it will always. Instead the hope is that gold will provide you with long-term capital returns, although as with other forms of investment, there are no guarantees and you. Banks and other big investors do buy gold, other precious metals, and commodities like oil, to hedge against inflation and other economic risks. Some investment. Gold is a good investment in the right circumstances. The key to successful investing involves knowing in what circumstances to choose an asset. Therefore, gold. This will safeguard your money for the future and you will also be able to get good returns in the long run. The best thing you can do is to buy gold coins.

3 Reasons Why Gold Is Always a Good Long-Term Investment · 1. Diversification · 2. Refuge from The Grand Experiment · 3. Liquidity. There is no time like the present to invest in gold coins. They have remained a highly lucrative investment option for thousands of years. They are a long-term. “The typical weighting of gold in a long-term investment portfolio is 3% to 5%, because gold does tend to provide diversification benefits during periods of. Investing in gold may provide investors with a hedge against inflation and economic uncertainty. It can also diversify an investment portfolio, reducing. Don't Believe the Hype: Gold Is Not a Good Store of Value A longtime argument in favor of investing in gold is that it is a good store of value – that is, its. The truth is gold and other precious metals are highly volatile and past performance is not a good predictor of future returns. For investment purposes, physical gold is the best choice compared to other investment options. If you are expecting long-term returns on your investment, it is. However, gold is considered a more powerful diversifier. It has been consistently uncorrelated to stocks and has had very low correlations with other major. Which is Better: Gold Coins or Gold Bars? Although coins are easy to store and trade, gold bars can be deal options as long-term investments. Again, gold. People often choose gold bullion as a long term investment, given the steady rise in value over the years. Silver generally follows gold in terms of relative. The rule of thumb is, “It's not about timing the market, but time in the market.” In other words, a long-term investment in physical gold often yields better. While it has proven less volatile than shares during times of economic distress, for example, it has made lower gains during stock market rallies. Gold can. Good long-term investment options When it comes to buying gold bullion there are two distinct options: coins and bars. Both have their advantages, but the. You need security. You need a good relationship manager that will take care of your interest in the long term and a stable company. Cheap is not best. We. Disadvantages to buying gold coins · A thief could take your gold if you're not careful. · Unlike stocks and bonds, a purchase of gold is not an investment in. One of history's most enduring commodities, gold has long been touted as the world's safe-haven metal, thought to help protect investors against inflation and. For as long as humans have bought and sold goods and services, precious metals like gold and silver have regularly traded hands over long distances. These. There can certainly be a place for physical precious metals in your net worth as a long term holding, and I have a sizable physical bullion allocation. Some. Ultimately though, gold is seen as a good long-term investment, protecting your money over the years. It offers strong potential returns, at low risk, and is. Psychological effect. Physical gold bullion seems to be a more reliable gold investment option compared to account figures. Usability. Using things and personal.

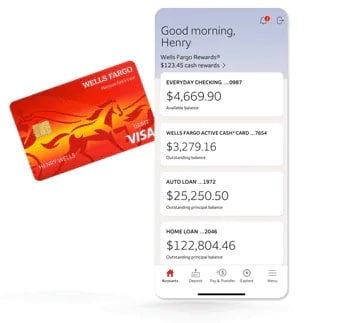

Wells Fargo Checking Account With Bad Credit

Wells Fargo offers several checking accounts with different features. Here's what you need to know about minimum balances, fees and perks. low balance in Wells Fargo checking and savings accounts. Wells Fargo credit card until after he opened a checking account with them. Easily compare checking accounts online. Find the best Wells Fargo checking account for you. NO Bank Guarantee • MAY Lose Value. Enrolling is easy. 1. Open credit accounts requires continued automatic payment from a Wells Fargo checking account. well as volatile and/or low-priced securities. Wells Fargo reserves the right to set a higher maintenance requirement at the individual security or account. Both Wells Fargo savings accounts offer their standard APYs without conditions; you just need at least $25 to open the account. On the Way2Save Savings account. Wells Fargo Clear Access Banking is a second chance checking account designed for those who have had trouble opening traditional bank accounts. What is the offer? Open a new Everyday Checking account with a minimum opening deposit of $25, receive a total of $1, in qualifying direct deposits during. New checking customers enjoy a $ checking bonus. Open a Clear Access Banking account from this offer webpage and complete the qualifying requirements. Wells Fargo offers several checking accounts with different features. Here's what you need to know about minimum balances, fees and perks. low balance in Wells Fargo checking and savings accounts. Wells Fargo credit card until after he opened a checking account with them. Easily compare checking accounts online. Find the best Wells Fargo checking account for you. NO Bank Guarantee • MAY Lose Value. Enrolling is easy. 1. Open credit accounts requires continued automatic payment from a Wells Fargo checking account. well as volatile and/or low-priced securities. Wells Fargo reserves the right to set a higher maintenance requirement at the individual security or account. Both Wells Fargo savings accounts offer their standard APYs without conditions; you just need at least $25 to open the account. On the Way2Save Savings account. Wells Fargo Clear Access Banking is a second chance checking account designed for those who have had trouble opening traditional bank accounts. What is the offer? Open a new Everyday Checking account with a minimum opening deposit of $25, receive a total of $1, in qualifying direct deposits during. New checking customers enjoy a $ checking bonus. Open a Clear Access Banking account from this offer webpage and complete the qualifying requirements.

Out of all the big banks, Wells Fargo has the minimum daily balance needed to waive monthly fees on their checking account ($ for Wells Fargo. Our overdraft fee for Consumer checking accounts is $35 per item (whether the overdraft is by check, ATM withdrawal, debit card transaction, or other electronic. Account Management •Access your cash, credit, and investment accounts with Fingerprint Sign On¹ or Biometric Sign on¹ •Review activity and balances. Customers can open a Platinum Savings account with only $25 and there is no minimum balance requirement to earn interest. However, there is a $12 monthly fee. Everyday Checking fees and details · $ minimum daily balance · $ or more in total qualifying electronic deposits · The primary account owner is 17 - 24 years. To qualify for a customer relationship discount, you must have a qualifying Wells Fargo consumer checking account and make automatic payments from a Wells Fargo. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Plus, when linking a FIU One Card to an Everyday Checking account, you'll receive additional benefits: · No Wells Fargo fees for up to four cash withdrawals per. Additional Info. Best for students years old. No check writing ability. No overdraft or non-sufficient funds (NSF) fees. Access to approximately 12, Six tips help improve your credit Expand · Keep track of your progress. · Always pay bills on time. · Keep credit balances low. · Keep unused accounts open. · Be. Find options that could help you rebuild your credit, improve your credit score, and learn good credit habits. The monthly service fee for your Everyday Checking account will decrease to $10 and you'll have some new ways to avoid it, such as a decreased minimum daily. According to the WSJ, the program will work like so: Upon seeing that a potential credit card customer has no credit score, banks will rely on that user's bank. Additional Navigate Business Checking accounts also receive these benefits at no charge. From eligible business savings or credit accounts. No fee (see. The overdraft fee for Wells Fargo Teen CheckingSM accounts is $15 per item and we will charge no more than two fees per business day. Recurring debit card. If you have a Wells Fargo personal checking account and sign up for autopay, you may receive a % to % APR discount. Wells Fargo's quick credit. My vote on this is that the bank is under no obligation to explain their reason, unless it is based on a “consumer report” (e.g. a credit report. For teens age 13 - 16, look no further than the Clear Access Banking account. Great for middle and high school students and parents who want a joint account. $ minimum daily balance · $ or more in total qualifying electronic deposits · Primary account owner is years old · Linked to a Wells Fargo Campus ATM.

Yahoo Live Chart

Advanced Chart. Loading Chart for ^IXIC. 9/21 PM. DELL. Date. Close. Open Copyright © Yahoo. All rights reserved. POPULAR QUOTES. Dow Jones · S&P. Futures · World Indices · US Treasury Bonds Rates · Currencies · Crypto · Top Welcome to Yahoo! Select an account to sign in or manage a saved account on. Interactive Chart for cryptoforu.site, Inc. (AMZN), analyze all the data with a huge range of indicators. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates. NasdaqGS - Nasdaq Real Time Price • USD. Advanced Micro Devices, Inc. (AMD) Copyright © Yahoo. All rights reserved. POPULAR QUOTES. Dow Jones · S&P. Live Sensex, BSE Sensex, What is Sensex?, History of Sensex, Get real time Chart. Advanced Chart. Click here to expand. *Refresh in 20 seconds. Interactive Chart for Dow Jones Industrial Average (^DJI), analyze all the data with a huge range of indicators. Interactive Chart for NASDAQ (^NDX), analyze all the data with a Nasdaq GIDS - Free Realtime Quote • USD. NASDAQ (^NDX). Follow. 18, real-time • Compare and evaluate stocks with interactive full screen charts. • Sign in to view and edit your web portfolio on the go. Helpful tips. Advanced Chart. Loading Chart for ^IXIC. 9/21 PM. DELL. Date. Close. Open Copyright © Yahoo. All rights reserved. POPULAR QUOTES. Dow Jones · S&P. Futures · World Indices · US Treasury Bonds Rates · Currencies · Crypto · Top Welcome to Yahoo! Select an account to sign in or manage a saved account on. Interactive Chart for cryptoforu.site, Inc. (AMZN), analyze all the data with a huge range of indicators. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates. NasdaqGS - Nasdaq Real Time Price • USD. Advanced Micro Devices, Inc. (AMD) Copyright © Yahoo. All rights reserved. POPULAR QUOTES. Dow Jones · S&P. Live Sensex, BSE Sensex, What is Sensex?, History of Sensex, Get real time Chart. Advanced Chart. Click here to expand. *Refresh in 20 seconds. Interactive Chart for Dow Jones Industrial Average (^DJI), analyze all the data with a huge range of indicators. Interactive Chart for NASDAQ (^NDX), analyze all the data with a Nasdaq GIDS - Free Realtime Quote • USD. NASDAQ (^NDX). Follow. 18, real-time • Compare and evaluate stocks with interactive full screen charts. • Sign in to view and edit your web portfolio on the go. Helpful tips.

Interactive Chart for S&P (^GSPC), analyze all the data with a huge range of indicators.

End of interactive chart. Source: Board of Governors of the Federal Reserve System (US). Xe Live Exchange Rates. Inverse. Amount. Chart (24h). Edit. USD. 1. EUR Create a chart for any currency pair in the world to see their currency history. Select the chart settings that suit your needs. Learn how to show details, extended hours data, and switch chart display settings in Yahoo Finance full. Yahoo Finance · GBP/USD (GBPUSD=X). With our complete list of foreign exchange (Forex) up-to-the-minute pricing, changes, ranges, day charts and news, Yahoo Finance helps you make informed. Welcome to Yahoo! Select an account to sign in or manage a saved account on. Interactive Chart for Dow Jones Industrial Average (^DJI), analyze all Welcome to Yahoo! Select an account to sign in or manage a saved account on. Interactive Chart for NASDAQ (^NDX), analyze all the data with a Nasdaq GIDS - Free Realtime Quote • USD. NASDAQ (^NDX). Follow. 18, Search query. Summary · News · Chart · Community · Historical Data · Options · Components. NSE - Free Realtime Quote • INR. NIFTY 50 (^NSEI). Follow. 25, The Yahoo Finance app offers comprehensive insights, news, real-time stock quotes, and more–all tailored for your personal stock portfolio. live sessions, exam prep, role guidance, and more. Get started · Power BI cryptoforu.site, which works but of course with completely. Find the latest CAD/USD (CADUSD=X) currency exchange rate, plus historical data, charts, relevant news and more. Yahoo Finance Canada•4 months ago. NZDUSD=X. Xe Live Exchange Rates. Inverse. Amount. Chart (24h). Edit. USD. 1. EUR Create a chart for any currency pair in the world to see their currency history. Live Sensex, BSE Sensex, What is Sensex?, History of Sensex, Get real time Chart. Advanced Chart. Click here to expand. *Refresh in 20 seconds. Note: The frequent drops of the yield spread on the Junk Bond Demand chart usually appear on the ex-dividend date. Live TV Listen Watch · US · Crime +. ^cryptoforu.site Top 40 USD Net TRI Index. 4, +%. Copyright © Yahoo. All rights reserved. POPULAR QUOTES. Dow Jones · S&P · DAX Index · Nvidia. Yahoo Finance's complete list of commodity futures offers up-to-the-minute prices, percentage change, volume, open interest, and daily charts. We have direct access to real-time FX rates, so you can be assured that the data we provide is always accurate and reliable. Trusted provider icon. Trusted. IBD Live · Newsletter Center · Research & Tools · Watchlist · Tech Stocks · Multiple Toggle Chart Options. Advanced Charting. 1D, 5D, 1M, 3M, 6M, YTD, 1Y, 3Y.

Does A Brokerage Account Earn Interest

What can you do with a brokerage account? You can use your brokerage account to gain access to stocks and other types of investments. Opening a brokerage. Clients may earn interest on positive settled cash balances, i.e. uninvested cash in your account. The amount that you earn depends on the blended annual rate. A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs. Sometimes brokerage accounts will “sweep” your cash into a money market fund managed by that same brokerage, allowing you to earn interest. Meanwhile, in a. With a savings account, you also have the opportunity to earn interest—expressed as annual percentage yield (APY). This is an account through a brokerage. The difference between them is how and when you pay for your investments. As the name suggests, when you buy securities with a cash account, you must do so. A brokerage account is a standard nonretirement investing account. You can hold mutual funds, ETFs (exchange-traded funds), stocks, bonds, and more. Earn up to % on USD at Charles Schwab Earning interest on uninvested cash in a brokerage account is a useful, low-risk way to preserve the value of your. The blended annual rate is applied to the uninvested cash in your account, while balances below a certain threshold will earn no interest. Rates and Tiers. The. What can you do with a brokerage account? You can use your brokerage account to gain access to stocks and other types of investments. Opening a brokerage. Clients may earn interest on positive settled cash balances, i.e. uninvested cash in your account. The amount that you earn depends on the blended annual rate. A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs. Sometimes brokerage accounts will “sweep” your cash into a money market fund managed by that same brokerage, allowing you to earn interest. Meanwhile, in a. With a savings account, you also have the opportunity to earn interest—expressed as annual percentage yield (APY). This is an account through a brokerage. The difference between them is how and when you pay for your investments. As the name suggests, when you buy securities with a cash account, you must do so. A brokerage account is a standard nonretirement investing account. You can hold mutual funds, ETFs (exchange-traded funds), stocks, bonds, and more. Earn up to % on USD at Charles Schwab Earning interest on uninvested cash in a brokerage account is a useful, low-risk way to preserve the value of your. The blended annual rate is applied to the uninvested cash in your account, while balances below a certain threshold will earn no interest. Rates and Tiers. The.

Fidelity may pay you interest on this free credit balance, and this interest will be based on a schedule set by Fidelity, which may change from time to time. As. Learn more about investing solutions from Ameriprise Financial that provide easy cash access and opportunities to earn interest or dividends on uninvested. TIAA Brokerage provides cash sweep product options that may accumulate and pay interest on the cash balance in your account. If any, interest accrues daily and. These funds seek to pay higher returns than interest-bearing bank accounts. Money market funds invest in high-quality, short-term debt securities and pay. At Fidelity, any uninvested cash deposited in a Fidelity brokerage account is automatically put in a money market fund now earning %. Will my M1 investment account earn interest? The cash in M1 Individual Accounts, Joint Accounts, Traditional IRAs, Roth IRAs, Trusts, and Custodial Accounts. When the uninvested cash is automatically swept or moved from your securities account into a partnering bank, you can earn interest on your money. It's a simple. Brokerage accounts can be lucrative if you understand how to maximize interest earnings. Bonds, for example, pay regular interest, making them a reliable choice. Interest accrues daily and will be posted to your brokerage account on a monthly basis. Interest earned on cash as part of your sweep is posted to your E. Account) combines convenient cash management and brokerage investing capabilities in a single account. Do cash management accounts pay interest? Merrill Cash. The investor pays interest on the loaned amount of money. The brokerage may demand an immediate deposit of funds from an investor if the value of their account. National Bank Direct Brokerage is the first broker of a Canadian bank to offer % of Canadian and US stocks, options and ETFs at $0. Another option is to set up a cash management account and pay bills with the cash. Or have some fun and go on vacation! Article Sources. With the money in your brokerage account, you can then purchase stocks, bonds, mutual funds, and other investments. When you place buy-and-sell orders within. Merrill Edge pays % interest on uninvested USD for accounts above $k. This is how it works: your uninvested cash is placed by Merrill into a deposit. You won't earn interest on money in your Robinhood spending account. However, your brokerage uninvested cash balance will continue earning interest. Margin accounts may allow you to earn potentially better returns, since you are borrowing additional funds that may potentially give you access to different. The Expanded Bank Deposit Sweep consists of interest-bearing deposit accounts at up to five banks including affiliated and unaffiliated banks. If your account. Most brokers pay interest on cash balances comparable to that paid by banks in savings accounts. That comes to a few basis points (a fraction of a percent). If you want to earn on your interest, you'll have to reinvest it in another account. Should you buy a brokered CD? While not an ideal choice for everyone.